Moonstone is positioned to provide guidance amid COFI uncertainty

Moonstone’s innovative approach to compliance, rooted in deep expertise and tailored guidance, is poised to help financial institutions not only comply but also thrive.

Moonstone’s innovative approach to compliance, rooted in deep expertise and tailored guidance, is poised to help financial institutions not only comply but also thrive.

The FSCA also warns of scammers impersonating 10X Investments, Prescient, Compsure Insurance, and Viviers Brokers.

A survey shows that only 8% of consumers lodged complaints with financial institutions between 2021 and 2023. Does this figure reflect genuine satisfaction or signal barriers in the complaint process?

Celebrating a quarter-century of innovation, Moonstone Information Refinery has transformed from a niche newsletter into a multifaceted provider of business solutions.

The revamped website will centralise all regulatory tools and services into one easy-to-navigate platform, making it simpler for FSPs to locate compliance information, verify credentials, and track enforcement actions.

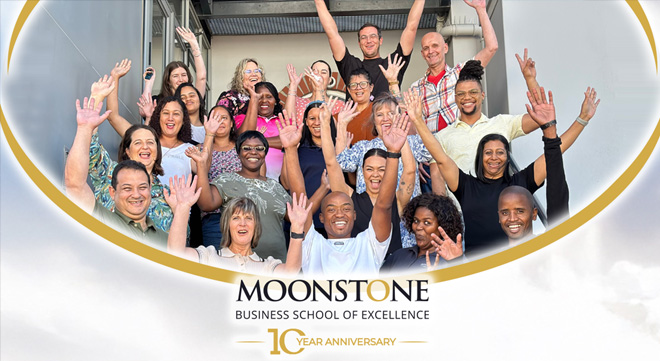

From its roots in corporate insurance training to leading the charge in online learning, Moonstone Business School of Excellence is shaping the future of financial services education.

Promises of unrealistic returns are clear sign that a scam is afoot.

Unathi Kamlana says the Authority will support the integration of advanced technologies and strengthen frameworks for consumer protection, cyber resilience, and financial inclusion.

The group recorded double-digit earnings, robust new business volumes, and an increased dividend, all underpinned by its tri-regional focus.

Moonstone Business School of Excellence’s regulatory short courses are among MBSE’s most popular offerings for FSPs looking to meet their CPD requirements.

FSCA also warns about unauthorised funeral policies being sold by a company in the Western Cape.

After months of speculation, Sanlam has officially partnered with Fedhealth as its exclusive open medical scheme provider.

CEO Michele Jennings says glu targets a wider audience with straightforward products and digital innovation.

Following 32 years with Old Mutual and nearly five as CEO, Iain Williamson is stepping down in August.

The FSCA also advises the public to be cautious of World Option Crypto and JoziEx.

It says the new business division, called glu, provide members with straightforward insurance solutions and profit-sharing.

MBSE top achievers Claudia Dowsett and Lana Johnson share how their qualifications have strengthened their professional confidence and client trust.

Notifications