Further education boosts confidence and expertise in financial planning

MBSE top achievers Claudia Dowsett and Lana Johnson share how their qualifications have strengthened their professional confidence and client trust.

MBSE top achievers Claudia Dowsett and Lana Johnson share how their qualifications have strengthened their professional confidence and client trust.

The FSCA has issued warnings about individuals and entities promising unrealistic returns while lacking the required authorisation to offer financial services.

The increase in certified professionals reflects both a growing recognition of the value of financial planners and a shift towards more inclusive, client-focused financial advice.

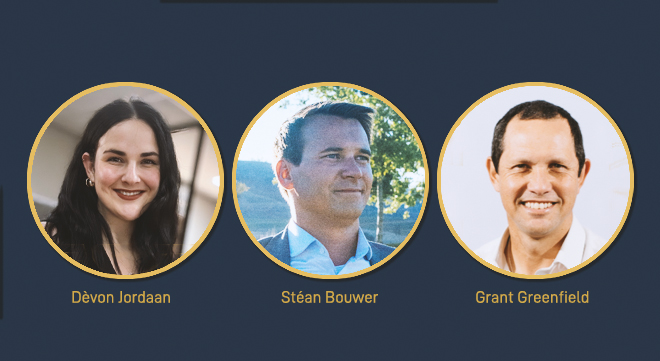

Dèvon Jordaan, Stéan Bouwer and Grant Greenfield, top achievers at Moonstone Business School of Excellence, share their stories on the power of preparation and perseverance.

Sava, a fintech startup backed by Access Bank South Africa, has received regulatory approval to launch a digital banking platform tailored to SMEs.

Impersonators are using the names of authorised financial firms, Truffle Asset Management and Vista Wealth Management, to defraud people.

AI-generated media make it seem as if one of South Africa’s richest people is endorsing an ‘investment’.

Financial institutions will participate in evaluating improvements to Conduct Standard 3 of 2020, aligning these efforts with the COFI Bill.

Fraudulent RE5 exam certificates were recently advertised on Facebook, sparking a public warning from the FSCA about regulatory exam fraud.

The FSCA says the scammers are also misusing the FSP number of a Bloemfontein-based financial planning business.

The surge in fraud underscores the urgent need for stringent compliance measures to protect clients and maintain trust amid rising threats.

The FSCA also alerts the public to individuals who may be providing financial services without authorisation.

Of the 420 CASP licence applications received, nine were declined, while 106 applications were voluntarily withdrawn.

Enrolling in selected NQF qualifications by 10 December will result in 50% off the first module, adding significant value to the entire course.

Profit from operations increased by 13% despite higher operating expenses attributed in part to implementing the two-pot system.

Santam will pay Sanlam Life R925 million to buy 60% of the A1 ordinary shares in NMS Insurance Services.

Mareo Nel resumed unauthorised forex trading despite signing an enforceable undertaking in 2021.

Notifications