FIC cracks down on RCR defaulters: R10 000 fine today, bigger sanctions tomorrow

Accountable institutions that did not pay the smaller fine or remediate their non-compliance now face harsher penalties.

Accountable institutions that did not pay the smaller fine or remediate their non-compliance now face harsher penalties.

Non-compliant accountable institutions are hindering efforts to get South Africa off the grey list, says the Financial Intelligence Centre.

The response to the Centre’s appeal to submit the outstanding risk and compliance returns ‘is not good enough’.

The relevant accountable institutions must submit the RCRs to avoid additional scrutiny or administrative sanctions.

Non-submission of the RCR required by Directive 6 will prevent the Financial Intelligence Centre from demonstrating compliance with the FATF’s action plan.

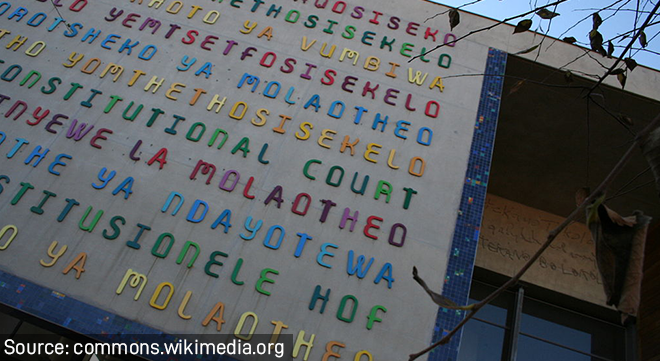

In a blow to foreign law graduates who have lived, studied and completed articles and pupilage in South Africa, the Constitutional Court has ruled that a section of the Legal Practice Act (LPA) […]

The Financial Intelligence Centre (FIC) has issued three reports aimed at equipping Krugerrand dealers, estate agents and lawyers to understand and identify the potential money laundering and terrorism-financing risks they face. The FIC […]

Tech Talk Legal, a series of free webinars that discuss the impact of technology on lawyers’ interactions with their clients and how legal professionals can use technology to enhance their practice, kick off […]

Notifications