Arrear contributions: FSCA publishes third list of defaulting employers

A longer annexure of employers who have cleared their arrears or arranged to do so signals the effectiveness of the Authority’s ‘name and shame’ campaign.

A longer annexure of employers who have cleared their arrears or arranged to do so signals the effectiveness of the Authority’s ‘name and shame’ campaign.

There is a legal grey area over the calculation of pension interest in divorce settlements and whether funds may now be permitted to make deductions for future maintenance orders.

SARS can appoint third parties to deduct tax debts directly from retirement funds, overriding the protections under the Pension Funds Act.

Financial planner Lara Warburton says clients believe trustee-endorsed annuities don’t offer enough flexibility or returns to sustain them through long retirement periods.

The FST orders the FSCA to reconsider key decisions regarding the Municipal Employees Pension Fund, saying the regulator overstepped its authority.

Muvhango Lukhaimane will also consult with trustees on guidelines for naming and shaming problematic funds, administrators, and employers.

The SA Retirement Annuity Fund is looking to the Supreme Court of Appeal to overturn a High Court decision in favour of the Pension Funds Adjudicator.

The exemption will apply pending the finalisation of the consultation process on the draft amendments to Conduct Standard 1.

Understanding the nuances of ‘pension interest’ and ensuring accurate wording in the divorce order is vital to avoid complications.

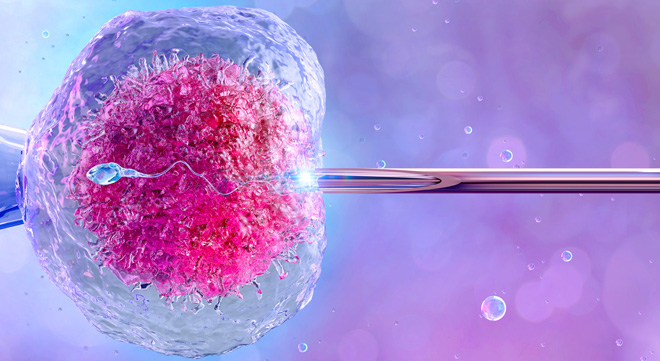

Sperm does not a father make and being a biological parent does not confer absolute rights, according to a ruling by the Pension Funds Adjudicator.

High Court hands down a decision on the interpretation of the tracing provision in section 37C of the Pension Funds Act.

Funds that cannot pay withdrawals because their rules are invalid must inform members why they may not be allowed to access their benefits.

The employee was told she would be granted immunity from prosecution if she agreed to sign the AOD.

The FSCA says submissions have either not been in the prescribed format or contain incorrect information.

The Authority also publishes the proposed changes to the section 14 application forms for public consultation.

The FSCA encourages members of retirement funds to check whether their employer is in arrears with their contributions.

The member, along with two others, was criminally charged because of allegedly fraudulent conduct that cost the employer R4 million.

Notifications