How to maximise your tax benefits in a two-pot era

Carla Rossouw, head of tax at Allan Gray, discusses what investors need to know about retirement fund products and the looming end-of-tax year deadline on 28 February.

Carla Rossouw, head of tax at Allan Gray, discusses what investors need to know about retirement fund products and the looming end-of-tax year deadline on 28 February.

This is double the initial estimate of between R5bn and R6bn.

SARS highlights common errors that can lead to application rejections and warns against attempts to evade tax.

The government, business, and labour are working together at Nedlac to address employers’ non-compliance with payments to retirement funds.

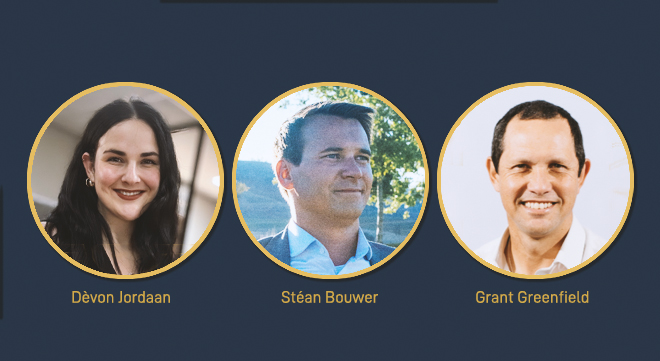

Dèvon Jordaan, Stéan Bouwer and Grant Greenfield, top achievers at Moonstone Business School of Excellence, share their stories on the power of preparation and perseverance.

The High Court describes the municipality’s persistent challenges to the fund’s applications as an example of the destruction of the country’s constitutional ethos.

The Engineering Industries Pension Fund and the Metal Industries Provident Fund use the personal liability provisions in the Pension Funds Act.

The Bill provides for flexibility when provident and provident preservation funds perform the seeding calculation.

After more than 20 years, the Authority is withdrawing Circular PF No. 127, which aimed to streamline surplus submissions for retirement funds in the termination process.

The two-pot system demands members make choices for vested, savings, and retirement components – all with distinct rules and tax implications. This complexity is driving the need for personalised advice and the systemic changes to support members effectively.

Survey finds that 57% are comfortable with having access to their savings, while 29% are concerned about the impact on their long-term savings.

The ruling underscores that disputes over unapproved disability claims underwritten by insurers through employer-held policies must be addressed with employers and insurers.

The company says 32% of its membership base have submitted claims with a value of about R6.5 billion.

The FSCA, National Treasury, and the Pension Funds Adjudicator tell MPs what they are doing to address the non-payment of retirement fund contributions. Regulatory interventions other than COFI may be in the offing.

The FSCA is evaluating whether administration fees are reasonable. If it believes they are not, it will explore whether it is necessary to cap or regulate fees.

Old Mutual’s Andrew Davison highlights why the two-pot system could lead to better retirement outcomes – and what trustees and advisers need to consider to make it happen.

FSCA plans to issue guidance on what it considers to be a fair and transparent approach to transaction fees.

Notifications