How to build a lasting legacy: wealth transfer strategies for families

From trusts to tax-smart retirement planning, here’s how to protect your estate, reduce taxes, and prepare the next generation to manage and grow your wealth.

From trusts to tax-smart retirement planning, here’s how to protect your estate, reduce taxes, and prepare the next generation to manage and grow your wealth.

Sanlam reports that most withdrawals came from financially strained members in mid-life, with little evidence that funds were used to reduce debt. Instead, spending patterns suggest pressure to cover everyday expenses.

Danie van Zyl of Sanlam Corporate Investments warns that allowing access to retirement components in retrenchment cases might jeopardise long-term savings and place added pressure on trustees.

Financial planners weigh in on the fallout and why investors should stay calm.

Carla Rossouw, head of tax at Allan Gray, discusses what investors need to know about retirement fund products and the looming end-of-tax year deadline on 28 February.

Employer interventions, including automatic contribution increases and making finance advice more accessible, are required to bridge the retirement age gap.

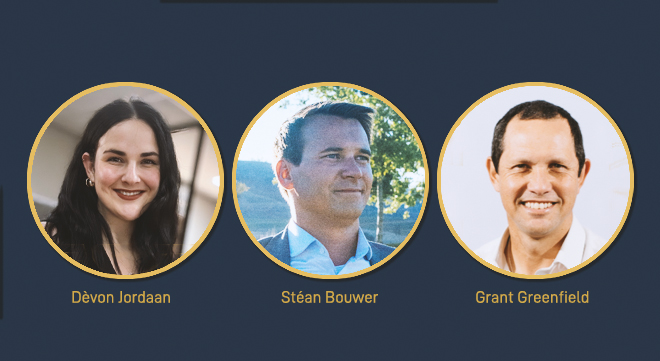

Dèvon Jordaan, Stéan Bouwer and Grant Greenfield, top achievers at Moonstone Business School of Excellence, share their stories on the power of preparation and perseverance.

Billy Seyffert unpacks 2024’s major compliance changes, from the two-pot retirement system to cybersecurity standards, offering practical advice to stay ahead in 2025.

The two-pot system demands members make choices for vested, savings, and retirement components – all with distinct rules and tax implications. This complexity is driving the need for personalised advice and the systemic changes to support members effectively.

Survey finds that 57% are comfortable with having access to their savings, while 29% are concerned about the impact on their long-term savings.

The ruling underscores that disputes over unapproved disability claims underwritten by insurers through employer-held policies must be addressed with employers and insurers.

The company says 32% of its membership base have submitted claims with a value of about R6.5 billion.

Old Mutual’s Andrew Davison highlights why the two-pot system could lead to better retirement outcomes – and what trustees and advisers need to consider to make it happen.

The marginal decrease in the average drawdown rate is noteworthy because it occurred in an environment of rising living costs, says ASISA.

Carina Wessels of Alexforbes discusses the urgent need for retirement funds to ‘learn forward as they lean forward’ to ensure long-term sustainability and relevance.

There is a legal grey area over the calculation of pension interest in divorce settlements and whether funds may now be permitted to make deductions for future maintenance orders.

After years of stalled progress, the FSCA’s recent comments suggest National Treasury may renew its push for auto-enrolment.

Notifications