Levies and fees weighed as PA prepares to regulate CISs and retirement funds

The PA shared an update on the six workstreams focused on the transition, confirming that they will be ready to regulate CISs and retirement funds by 1 April 2026.

The PA shared an update on the six workstreams focused on the transition, confirming that they will be ready to regulate CISs and retirement funds by 1 April 2026.

The SARB freezes 506 million Pepkor shares held by Ainsley, a subsidiary of Ibex, which took over Steinhoff’s assets and liabilities following its liquidation.

As the KwaZulu-Natal government scrambles to keep Ithala afloat, its urgent request for a R2.4 billion loan from National Treasury sparks confusion – especially given an earlier government guarantee.

A PA-commissioned solvency report questions Ithala’s financial health, raising concerns about its equity, loan book, and potential shortfall in repaying depositors.

The arrest of two more former Steinhoff executives ties back to a fraudulent scheme involving a handwritten note by Markus Jooste.

Meanwhile, MPs have questioned the SARB’s push to liquidate Ithala, arguing it conflicts with Parliament’s resolution to support the bank’s growth.

Stable growth and fiscal discipline could see South Africa’s credit rating rise two notches in the next three years.

Sava, a fintech startup backed by Access Bank South Africa, has received regulatory approval to launch a digital banking platform tailored to SMEs.

Ithala accuses the appointed repayment administrator of overstepping his authority, while the Prudential Authority moves to liquidate the entity.

The Prudential Authority’s push for Ithala’s provisional liquidation has brought the bank’s journey to an abrupt halt, leaving 257 000 depositors in limbo.

The bank’s Financial Stability Review also flags the growing financial distress among households and SMMEs and the vulnerabilities in the commercial real estate sector.

The SARB plans to continue enforcement action against Ibex Holdings, formerly Steinhoff, and other parties but may consider a settlement to resolve the matter.

Having reached the target of 4.5% with ‘little or no cost’, Lesetja Kganyago argues that South Africa can achieve permanently lower inflation and interest rates.

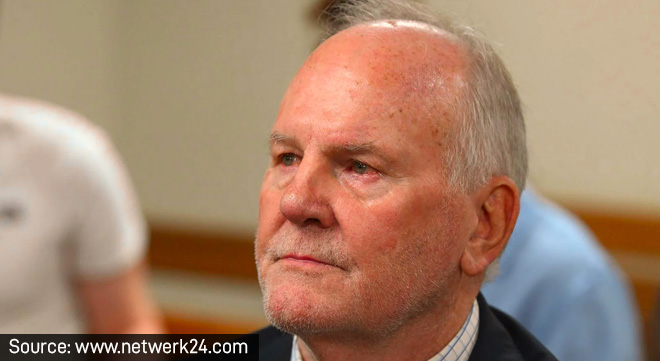

Stephanus Grobler, who is facing multiple charges including racketeering and fraud, is due to appear in court in February next year.

How low will the repo rate drop, and how fast? Economists share their insights.

With the South African Reserve Bank’s 25 basis point interest rate cut announced last week, Ninety One explores the central bank’s new inflation measures – supercore and PCCI.

The South African Reserve Bank’s inaugural Payments Study Report provides extensive insights into how the public perceives and uses various payment methods and instruments.

Notifications