Steinhoff’s shadow still looms over Pepkor as SARB freezes shares

The SARB freezes 506 million Pepkor shares held by Ainsley, a subsidiary of Ibex, which took over Steinhoff’s assets and liabilities following its liquidation.

The SARB freezes 506 million Pepkor shares held by Ainsley, a subsidiary of Ibex, which took over Steinhoff’s assets and liabilities following its liquidation.

The arrest of two more former Steinhoff executives ties back to a fraudulent scheme involving a handwritten note by Markus Jooste.

The judgment highlights the impact of Steinhoff’s collapse on retirement funds and the public’s right to understand the nation’s biggest corporate scandal.

The SARB plans to continue enforcement action against Ibex Holdings, formerly Steinhoff, and other parties but may consider a settlement to resolve the matter.

Stephanus Grobler, who is facing multiple charges including racketeering and fraud, is due to appear in court in February next year.

La Grange was sentenced to 10 years in prison, with five years suspended contingent on his co-operation with the State in future cases involving Steinhoff’s executives.

Dr Gerhard Burger, who travelled with Steinhoff directors to oversee their health, pleaded guilty to three counts of insider trading.

The South African Reserve Bank has seized more than R6 billion from various Ibex Investments accounts, previously Steinhoff.

The NPA indictment against former executives Stéhan Grobler and Ben la Grange details how they earned millions due to inflated share prices based on false profits.

The National Prosecuting Authority’s indictment against former Steinhoff executives lays bare a ‘sophisticated washing machine’ that generated ‘entirely illusory profits’.

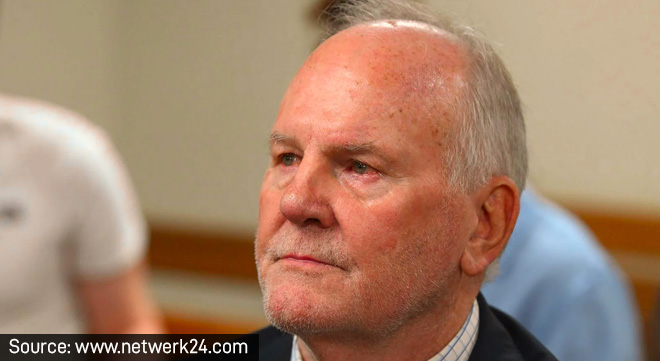

The retailer’s former head of legal, Stephanus Grobler, appeared in the dock with Ben la Grange.

The SARB has forfeited to the state cash totalling R42m from Berdine Odendaal’s bank accounts, as well as her R18m property in Paarl’s Val de Vie estate.

The late Markus Jooste’s alleged romantic partner has applied to the SCA for permission to appeal the High Court’s ruling that effectively bars her from accessing a monthly living allowance of R150 000.

A fiduciary expert discusses the legal complexities surrounding attached assets in the wake of Markus Jooste’s death.

A former Steinhoff executive appeared in the Specialised Commercial Crimes Court on Friday charged with fraud and racketeering.

Jooste was more blameworthy than others because he deliberately contravened the law and was well qualified to understand his conduct’s implications, the FSCA says.

The FSCA is still waiting for him to make good on the reduced fine of R20m imposed in December 2022 for insider trading.

Notifications