Retirement funds get exemption from using prescribed section 14 transfer forms

The exemption will apply pending the finalisation of the consultation process on the draft amendments to Conduct Standard 1.

The exemption will apply pending the finalisation of the consultation process on the draft amendments to Conduct Standard 1.

South Africa has the potential to boost its savings rate and secure a more stable source of funding for fixed investments, essential for driving economic growth.

Commentators did not raise any significant concerns in their responses to the draft conditions, the FSCA says.

A request for a tax directive will be declined if a member is not a registered taxpayer or has outstanding returns.

Members should find out whether they will be eligible to withdraw money from their savings components.

If a fund cannot follow the standard allocation methods, it must apply for FSCA approval to use an alternative, reasonable method.

The type of fund to which a member belongs may improve or undermine the preservation of retirement fund assets, says Allan Gray.

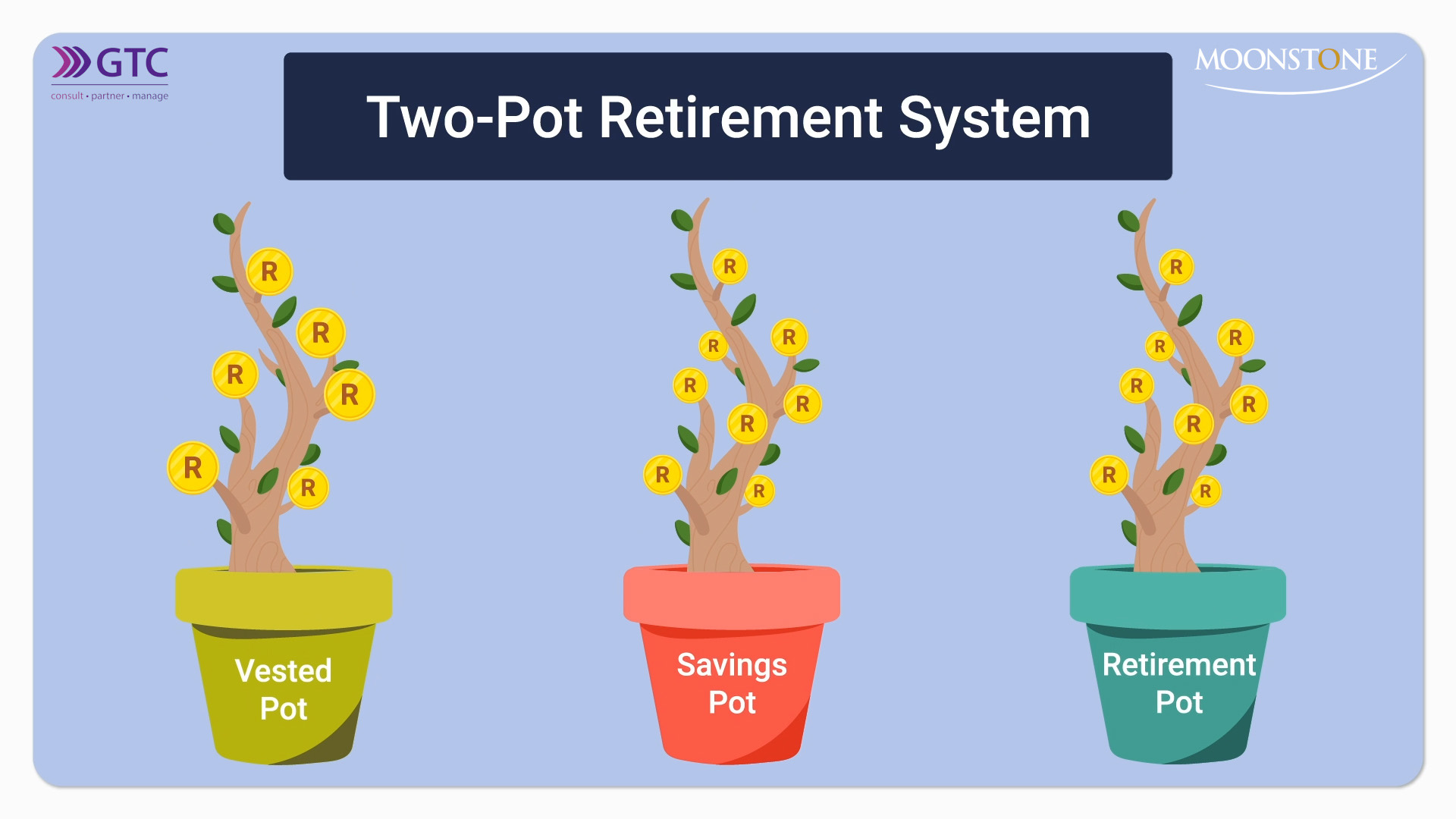

It is accompanied by three brochures that unpack different aspects of the two-pot system in more detail.

As the two-pot retirement system goes live on 1 September, intermediaries must prepare to guide clients through the new structure.

Economists assess the possible impact of the reforms on household consumption, real fixed investment, inflation, government debt, and GDP growth.

Clients whose financial habits have been moulded by sound advice over many years are unlikely to act irresponsibly now, says Fairbairn’s Guy Holwill.

Advisers should be able to show that all the other available options have been considered, says Old Mutual’s Lizl Budhram.

Among other things, funds will have to show that participating in the two-pot system will negatively impact members’ benefits.

Retirement fund members must ensure their fund has their correct details and they are registered as a taxpayer with SARS.

Funds that cannot pay withdrawals because their rules are invalid must inform members why they may not be allowed to access their benefits.

Actuarial calculations may affect the costs and time for defined-benefit fund withdrawals, depending on the rules of the fund and the complexity involved.

Old Mutual’s learnings about what people know or expect, based on its interactions with customers and advisers.

Notifications