Under normal circumstances, this article would provide you with a round-up of the Budget’s key changes that will impact individual taxpayers and investors over the coming fiscal year. But, as is well known, the Budget was postponed at the last minute on Wednesday, and it is now scheduled to be tabled on 12 March.

If Finance Minister Enoch Godongwana had delivered his Budget Speech as planned, South Africans would by now be coming to grips with the implications of an increase of two percentage points, or 13.3%, in the rate of value-added tax, from 15% to 17%, effective from 1 April.

National Treasury cited “new and persistent spending pressures” as the reason for the increase.

According to the 2025 Budget Review, the government needs to raise R58 billion in additional revenue in 2025/26 to address its spending needs.

Godongwana was to tell Parliament that the government’s options were:

- continue to cut funding to essential services;

- take on expensive debt that will burden future generations; or

- make “strategic tax adjustments to secure our nation’s future”.

He ruled out the first option, saying the government could not cut frontline services, referring specifically to education and health.

The minister was also opposed to taking on more debt, because doing so when the country’s credit rating is at junk status, would lead to even higher interest payments, ultimately reducing the government’s future spending capacity and raising the risk of further rating downgrades.

More debt would also push up interest rates, which would hurt households paying back loans and businesses looking to expand their operations, dampening investment across the economy.

National Treasury expects public debt to peak in 2025/25, stabilising at R6.09 trillion, or 76.1% of GDP, because of a growing primary budget surplus (revenue exceeding non-interest spending). However, this an increase from the debt-to-GDP ratio of 75.5% forecast for 2025/26 in the Medium-Term Budget Policy Statement in October last year.

Treasury expects the consolidated budget deficit to narrow from 5% of GDP this year to 3.4% of GDP in 2027/28.

Debt-service costs will rise from R389.6bn in 2024/25 to R477.2bn in 2027/28, but as a percentage of revenue, debt-service costs will stabilise at 21.7% in 2024/25.

Treasury says servicing debt now consumes 22 cents of every rand of revenue. “The cost of servicing South Africa’s government debt is significantly higher than in peer countries, and this contributes to high borrowing costs for households and businesses.”

Treasury forecast the increase in the VAT rate would add R60bn in revenue in the 2025/26 fiscal year, an additional R63.675bn in 2026/27, and R67.3bn in 2027/28. These are the gross VAT collections before factoring in the impact of the proposal to expand the zero-rating of certain foodstuffs, which would amount to R2bn in 2025/26.

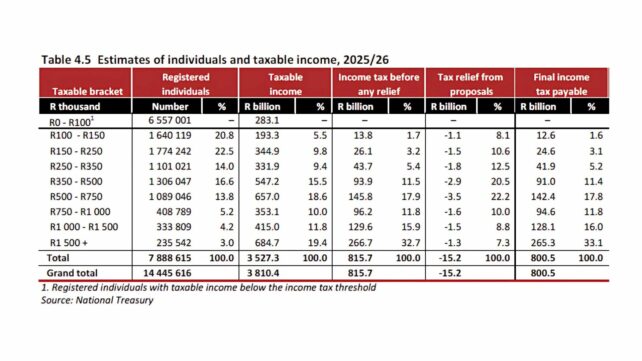

According to the Budget Review, VAT would contribute R545.4bn in tax revenue in 2025/26, R579.1bn in 2026/27, and R612.4bn in 2027/28 – the second-largest source of tax revenue after personal income tax (PIT), which was forecast to raise R800.4bn in 2025/26, R850.9bn in 2026/27, and R910.8bn in 2027/28. By comparison, Treasury expected corporate income tax to contribute R325bn in 2025/26, R360.3bn in 2026/27, and R385.4bn in 2027/28.

Measures to soften the blow

The financial minister proposed mitigating the impact of the VAT increase by:

- Expanding the basket of VAT zero-rated food items from the current 21 items. The revised basket was to include tinned and bottled vegetables, dairy liquid blends, and a variety of meat products (sheep, poultry, goat, and swine). Expanding the basket of zero-rated items would result in the government foregoing revenue of R2bn in 2025/26.

- Not increasing the fuel levies, foregoing about R4bn in revenue in 2025/26.

- Providing above-inflation increases to the social grants. The old age grant, war veterans grant, disability grant, and care-dependency grant were each to increase by R150 on 1 April. The foster care grant was to increase by R80. The child-support grant and grant-in-aid grant were to increase by R50.

The government also planned to extend the Social Relief of Distress (SRD) grant for another year, allocating R35.2bn to this item, but keeping the grant at R370 per month per beneficiary.

Godongwana told a media briefing that the government is appealing a High Court judgment in January whose orders would significantly increase the cost of funding the SRD grant. He called the judgment “unacceptable”, saying the government could not afford to expand the grant as envisaged by the court’s orders.

Read: Court ruling on SRD grant could deepen the government’s fiscal crisis

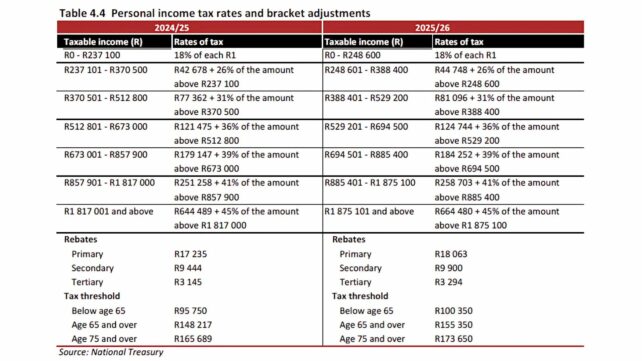

Adjustments to the income tax brackets

Another proposal to mitigate the impact of the VAT hike was to adjust the personal income tax brackets. The two bottom income tax brackets and all the rebates were to be “fully” adjusted for inflation, while the remaining brackets were to be adjusted partially.

The primary rebate was to increase by 4.8%, from R17 235 to R18 063; the secondary rebate, for those 65 to 74, by 4.82%, from R9 444 to R9 900; and the tertiary rebate, for those aged 75 and over, by 4.7%, from R3 145 to R3 294.

These adjustments would also mitigate bracket creep – the term commonly used to describe what happens when the income tax brackets are not fully adjusted to account for inflation-linked salary increases. Taxpayers whose salaries are adjusted in line with inflation are pushed into a higher tax bracket and pay relatively more in tax. In last year’s Budget, the tax tables were not adjusted for inflation.

Medical tax credits would remain

Medical tax credits would remain

There has been speculation that the government will scrap the medical tax credits that can be claimed by members of medical schemes and redirect the money into National Health Insurance. But the Budget proposed retaining the tax credits for another year.

However, the credits would not be adjusted for inflation, remaining at R364 per month for the first two beneficiaries and R246 per month for the remaining beneficiaries.

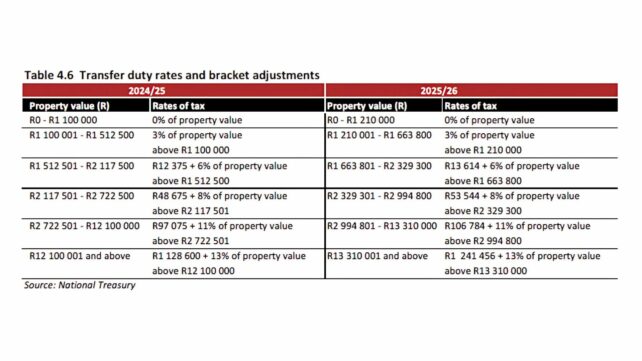

Transfer duty on property transactions

The Budget proposed increasing the thresholds for transfer duties by 10% on 1 March to compensate for inflation. The transfer duty tax rates would remain unchanged.

Excise duties on alcohol and tobacco

Excise duties on alcohol and tobacco

The Budget proposed increasing the excise duties by 4.83% for cigarettes, cigarette tobacco, and vaping, formally called electronic nicotine delivery systems (ENDS) and non-nicotine delivery systems (ENNDS). The proposed increase for pipe tobacco and cigars was 6.83%.

The excise duties on alcoholic beverages would increase by 6.83%.

Ad valorem excise duties on smartphones

The Budget proposed that as of 1 April the 9% ad valorem excise duty on smartphones would apply only to smartphones with a price of more than R2 500 at the time of export to South Africa.

No changes proposed

There would be no changes to the following taxes:

- Capital gains tax, dividends tax, donations tax, estate duty, the exemptions on interest income, and tax-free investments.

- The tax deduction for retirement fund contributions.

- The Health Promotion Levy (commonly called the sugar tax).