The rules around the payment of proceeds from South African long-term insurance policies to foreign bank accounts can be confusing. Alix Moreillon, legal adviser at Allan Gray, clarifies when annuity income from a living annuity may be paid to a foreign bank account and explains the exchange control regulations surrounding these payments.

South African legislation specifically prohibits the transfer of living annuities to other financial services providers abroad. This means that as a South African living annuitant, if you are emigrating or cease to be a South African tax resident, you will not be able to access the capital underlying your South African living annuity policy, and you will continue to receive annuity income from the issuer of that policy.

It is important to remember that the concept of residency for tax and exchange control purposes varies – care should be taken when considering this terminology in different contexts.

How to receive your annuity income

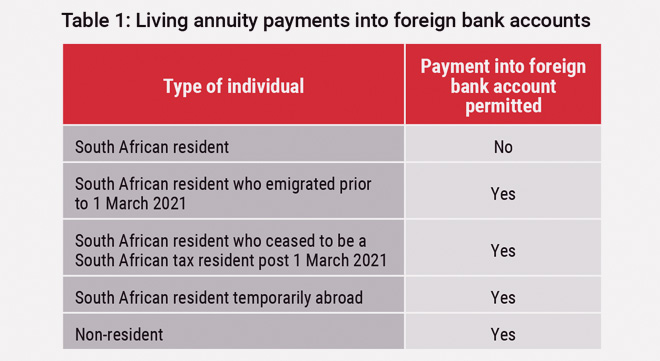

In certain circumstances, annuity income may be paid to a foreign bank account held in the name of an annuitant. The different limitations are contained in the Currency and Exchanges Manual for Authorised Dealers. These limitations vary depending on whether the individual is a South African resident, a resident who financially emigrated prior to 1 March 2021, a resident who ceased to be a tax resident after 1 March 2021, a resident who is temporarily abroad, or a non-resident. These different parameters are discussed below.

South African resident

The Manual does not permit the payment of annuity income to a foreign bank account for South African residents. However, as a South African resident, you may receive payment of your annuity income to your South African bank account and transfer this amount abroad as part of your annual single discretionary allowance (SDA) or foreign capital allowance (FCA).

The SDA is available to South African natural persons who are 18 years and older and permits transfers of up to R1 million per individual per calendar year outside the Common Monetary Area (CMA) – Eswatini, Lesotho, Namibia, and South Africa – without the requirement to obtain a Tax Compliance Status (TCS) PIN from the South African Revenue Service (Sars), which may be obtained online.

If you want to transfer more than R1m, you may use your FCA, which allows residents to transfer an additional amount of up to R10m in their name outside the CMA, per calendar year. For the purposes of the FCA, Sars introduced an enhanced TCS process in April 2023, known as the “Approval for International Transfer (AIT)” process.

This enhanced process combines the TCS process for emigration and the FCA. Sars requires additional information to process these requests, such as the disclosure of local and foreign assets held by the investor. There are two TCS types for which a taxpayers can apply:

- Good standing is issued when a taxpayer wants to confirm that their tax affairs are in order with Sars.

- The AIT allows a taxpayer to apply to transfer funds internationally. This process applies to South African residents who want to use their FCA and to non-residents who are transferring funds from a South African source.

South African resident who emigrated prior to 1 March 2021

Individuals who emigrated prior to March 2021 had to keep a rand-blocked account open in South Africa. This account was used for exchange control purposes to remit capital transfers from South Africa, and international payments made from South Africa were processed through these accounts. However, the concept of rand-blocked accounts has fallen away.

Therefore, if you formally emigrated prior to 1 March 2021, you would need to follow the AIT process described above to transfer funds from South Africa. This process is administered through Sars and is required regardless of the value of the annuity income that is paid because the SDA does not apply to non-residents. Additionally, verification of your tax compliance will be required through the TCS of good standing process.

South African resident who ceased to be a tax resident after 1 March 2021

If you cease to be a South African tax resident, the Manual permits the payment of pensions and/or compulsory annuities directly to a foreign bank account held in your name. The process of ceasing to be a South African tax resident is administered through Sars.

Again, the AIT process will need to be followed regardless of the value of the annuity income that is paid. Additionally, a TCS of good standing will be required by your authorised dealer annually. A TCS of good standing enables you to authorise any third party to view your tax compliance status online via eFiling.

South African resident temporarily abroad

If you are abroad temporarily, which the Manual defines as having “departed from South Africa to any country outside the CMA with no intention of taking up residence or who has not been granted permanent residence in another country, excluding those residents who are abroad on holiday or business travel”, you can have your income paid into a foreign bank account in your name. Note that this income is not included as part of your SDA or FCA.

Non-resident

If you are a non-resident – that is, your normal place of residence is outside the CMA – the Manual allows for annuity income to be paid into a foreign bank account in your name. A non-resident in this context is an individual who has never been considered a South African tax resident. As the annuity income originates from a South African source, the AIT process will need to be followed.

Your tax residency status is the defining factor

Table 1 shows who is typically allowed payment into foreign bank accounts. Whether you can receive your living annuity income into your foreign bank account will depend on your tax residency, the South African Reserve Bank and Sars requirements, and your insurer’s processing procedures.

Your independent financial adviser or financial services provider can help you to determine whether you are eligible for foreign payments in terms of the Manual.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute financial planning, legal or tax advice that is appropriate to every individual’s needs and circumstances.