Since the peak in global equity markets on 17 July, just before the Black Monday crash, the high-dividend-yielding tobacco companies Altria and British American Tobacco (BAT), listed in the US consumer defensive sector, have delivered strong performances compared to the US market.

Altria’s stock price is up by nearly 8.7% in US dollars, while BAT is up by 16.6% in US dollars, 17.3% in British pounds, and 15.7% in rands. In comparison, the Russell 1000 Growth and Value indexes are up by 1% and 4.8%, respectively.

But what is the outlook for this “… unloved industry, which is seemingly under permanent regulatory scrutiny and pressure” (Anchor 2019)?

The pricing of tobacco shares

I view the two high-yielding tobacco companies as a fusion of equity and interest-bearing assets.

The dividend growth of Altria and BAT was steady at about 8% and 5% per year respectively since 2010 and compares with about 7% a year for the Russell 1000 Value index over the same term.

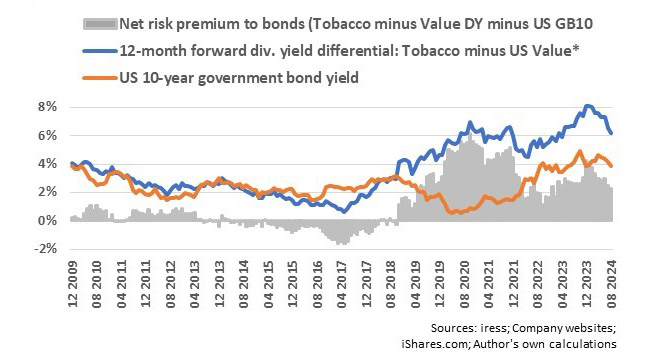

For practical purposes, I equally weighted the one-year forward dividend yields of Altria and BAT to obtain an average forward dividend yield. The gap between the tobacco forward yield and that of the Russell 1000 Value index is an indication of the average risk premium priced into the two tobacco shares.

From the accompanying graph, it is evident that from 2009 to 2016 the risk premium (or yield gap) of tobacco shares effectively reflected the US 10-year government bond yield. From 2017 to 2019, the tobacco companies were severely derated by the market.

Headwinds

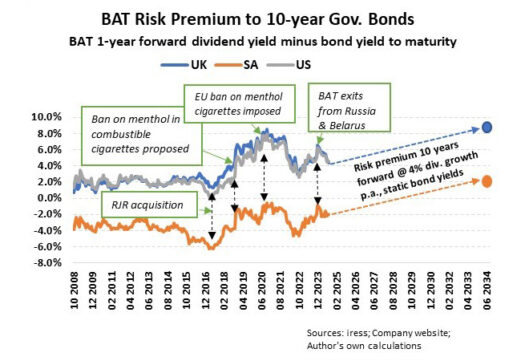

Tobacco companies faced strong headwinds from 2017 with US proposals to ban menthol in combustible cigarettes, suits by Canadian provinces, and the outright European Union-wide ban on menthol cigarette sales on 20 May 2020. In addition, BAT’s acquisition of the remaining stake of RJR Tobacco landed BAT with a massive debt burden.

Tailwinds

However, the EU ban in 2020 also signalled a peak in the risk premium. Tobacco stocks rallied through May 2022 as risk premiums eased. Thereafter, the risk premium followed US 10-year government bond yields higher and peaked in January this year at 8% when BAT finally pulled out of Russia. Since then, the risk premium has followed the downtrend in US 10-year government bond yields and sits at 6%.

The tobacco stock rally since the peak in the risk premium is remarkable. Altria’s stock price is up 33.5%. BAT is up 28% in pounds, 31% in US dollars, and 24% in rands. That compares with the Russell 1000 Growth and Value Indexes’ 23.9% and 13.1% respectively.

Although the structural decline in the traditional cigarette-smoking market continues, innovation and capital spend on next generation products are already filtering through to the bottom lines of tobacco companies – to such an extent that mid-single-digit profit and dividend growth is probable in the medium to long term.

Fairly priced

At this stage, it appears as if the gap between tobacco’s risk premium (net of the market) and US 10-year government bond yields could stabilise at the current 2%. What this means is that tobacco company stocks are totally at the mercy of movements in US government bond yields. A 100-basis point move higher in 10-year bond yields will translate in the same move in the one-year forward dividend yield of tobacco companies, resulting in a capital loss of about 12%. That is about double the capital loss on a 100-point rise in the US 10-year government bond. In contrast, all other things being equal, a 100-point drop in the 10-year bond yield could lead to a 14% capital gain in tobacco shares.

The risk of investing in tobacco shares has undeniably increased. Given the stages of the economic and investment cycles, I continue to hold them for superior dividend income growth relative to bonds, though.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.