US stocks have surged since Donald Trump won the presidential election and the Republican Party made a clean sweep in both the Senate and House of Representatives.

Economists and analysts have upped their forecasts for the US economy and so have analysts regarding corporate profits. The situation is fluid, though, and forecasts can change dramatically because it remains to be seen when, how, and to what extent Trump’s policies will be enacted.

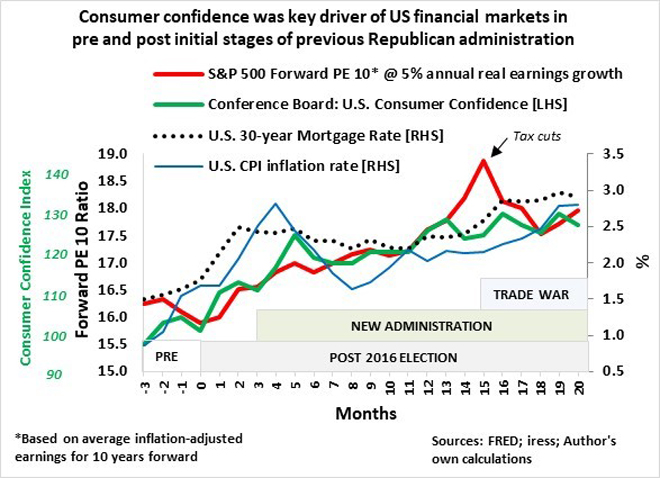

In my opinion, consumer confidence will be the golden thread in Trump’s policies going forward – as it was during Trump’s previous term.

In November 2016, the Conference Board’s Consumer Confidence Index jumped by nearly 9% month-on-month after Trump’s election, followed by another 3.5% rise in December that year. Following Trump’s inauguration in January 2017, consumer confidence rose by 4% month-on-month in February and 7.5% in March, eased by about 4% in April, and climbed steadily through November that year despite rising inflation and higher mortgage rates.

The broad US stock market closely tracked the Consumer Confidence Index from the election month (November 2016) through November 2017. The rating of the US stock market, measured by the S&P 500 forward PE 10 ratio (calculated by dividing the real price by the average inflation-adjusted earnings 10 years forward), expanded by 12% to 17.8 in November 2017 from 15.9 times in October 2016 (pre-election month).

The US dollar soared by about 4% over the first two months after Trump’s election in 2016. At the time of Trump’s inauguration in January 2017, however, Trump made it clear that his administration wanted a weaker US dollar to increase the ability of US companies to compete and retain and create jobs. Despite many sceptics, it is evident that he succeeded in his goal.

The dollar started to weaken immediately after Trump took the oath of office in January 2017. The widely used Nominal Broad US Dollar Index gradually fell by 7.7% from the end of December 2016 to the end of September 2017.

Consumer and business confidence in the first three quarters of Trump’s presidency were underpinned by a solid economic showing and a drop in mortgage rates.

Unemployment fell to 4.2% from 4.7% (December 2016), capacity utilisation increased by 1.5%, house prices (S&P CoreLogic Case-Shiller US National Home Price Index) rose by nearly 6% (annualised), the 30-year Fixed Rate Mortgage Average fell to 3.8% from 4.3%, the manufacturing sector surged, with the US ISM manufacturing purchasing managers’ index jumping to 60.2 from 54.5 (December 2016), and real disposable personal income increased by 3.7% (annualised).

Consumer and business confidence were underscored by Trump’s promise of deep tax cuts, which he made good in December 2017 by signing into law the biggest tax overhaul since 1986 whereby the top corporate income tax rate was slashed from 35% to 21%, while the top marginal tax rate for individuals fell to 37% from 39.6%.

It is evident that the prospect of lower corporate taxes was the main contributor to the 5% outperformance of the US stock market (measured by the S&P 500 index) against the rest of developed markets (measured by the MSCI World Ex USA Index in US$) over the period from Trump’s election in 2016 to November 2017.

The signing of the tax law led to a significant diversion between the valuation of the US stock market and consumer confidence in December 2017 and January 2018 as stocks surged, but it was relatively short-lived. In January 2018, Trump began imposing tariffs and trade barriers on China, which started a trade war between the US and China that escalated through 2019. US stocks eased and the valuations again resumed tracking consumer confidence.

This time round, Trump’s policies are effectively a continuation from where he left off during his previous term, and virtually all of them are to boost consumer confidence. Raising tariffs on imports and reversing limits on energy projects are aimed at preserving and creating jobs, while lower corporate and personal income taxes will boost coffers.

In my view, the 6% outperformance of the US stock market relative to the MSCI Ex USA Index in US$ since Trump’s landmark victory in November this year can be solely attributed to Trump’s proposal to extend his 2017 tax cuts beyond 2025 and lower the corporate tax rate from 21% to 15%.

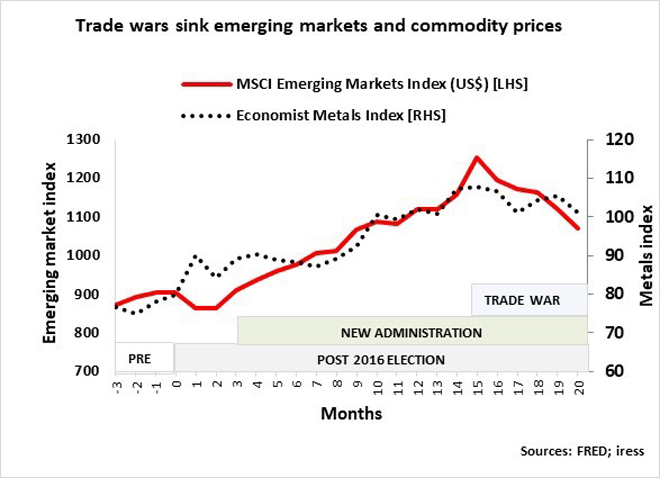

Emerging markets’ underperformance of nearly 8% over the same period has much to do with Trump’s tariff threats.

Trump’s previous effort to make the US competitive again and get Americans to “buy” American consisted of two legs: first, a successful devaluation of the greenback and after that, imposing tariffs and trade barriers. This time round, it seems he envisages the two running together, but prominent economists warn that tariff increases – such as 20% tariffs on all imports, 60% tariffs on Chinese imports, and 200% tariffs on imported vehicles from Mexico – will push up the dollar because countries will short their currencies against the dollar to remain competitive. Furthermore, it will force US inflation higher because Americans will need to pay up for imported goods.

It is therefore no wonder that Trump on Friday picked hedge fund manager Scott Bessent as the next US Treasury secretary. According to Bloomberg, Bessent has acknowledged that “while a weaker dollar would be good for some parts of the economy, some of Trump’s proposals would drive up its value”. So, in essence it means that the tariffs to be imposed could be far lower than Trump propagated.

In Trump’s first 100 days in office in 2017, he signed 24 executive orders, 22 presidential memoranda, 20 presidential proclamations, and 28 bills. A similar pattern is likely when he assumes office in January 2025, and all are likely to be supportive of consumer and business confidence.

Consumer confidence can suffer setbacks, though.

Elon Musk’s appointment as the co-head of the new Department of Government Efficiency, established to cut the size of government, is likely to be a contentious issue among lawmakers in Washington and will from time to time pour cold water on consumer and corporate confidence in coming quarters as budget cuts mean job losses and a loss of contracts.

An escalating trade war, specifically involving China, can lead to supply chain disruptions and subsequent job losses and higher inflation, while a further escalation in geopolitical tensions can sink consumer and business confidence. Emerging markets and commodities are extremely vulnerable if that happens.

I do think that Trump’s economics is bullish for US consumer confidence and US stock markets in general.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.