Santam says the underwriting actions it implemented in response to the challenging operating environment are bearing fruit, with its underwriting margin increasing to 7.5% in the first six months of its 2023 financial year, from 5.6% in the comparable period in 2022.

The underwriting margin assesses the profitability of an insurance company’s core underwriting activities.

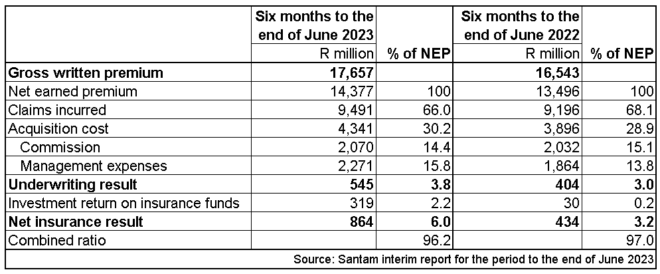

The non-life insurer reported a net underwriting margin (a measure of profitability) of 3.8%, which was below the group’s target range of 5% to 10%, but it was an improvement on the 3% in the comparable period last year.

The underwriting profit increased by 35%, from R404 million to R545m, net earned premiums increased by 6.5%, and claims rose by 3.2%.

The return from invested insurance funds jumped from R30m to R319m, contributing to Santam’s net profit from conventional insurance business, from R434m to R864m.

Santam, valued at about R34 billion on the JSE, has a 22% share of the short-term market in South Africa.

The group’s interim profit soared by 137% to R1.37bn, and headline earnings per share jumped by 146% to R11.70 a share. It declared an interim dividend of R4.95 a share, about 7% higher than in the previous comparable period.

Conventional insurance business

The table below provides key metrics for Santam’s conventional insurance business in the six months to the end of June.

Santam said several large items impacted the comparability of the results:

- Both reporting periods include significant losses of more than R300m, mainly because of fires.

- Floods in the Western Cape resulted in losses of R150m, and Santam Re’s exposure to earthquakes in Türkiye added losses of R150m. Santam Re’s reinsurance programme limited its losses to the retention amount of R150m.

- Run-off losses of more than R100m were experienced in respect of a cancelled unprofitable Israeli motor business at Santam Re.

- The 2022 period included net losses of R566m (including reinstatement premiums) because of the floods in KwaZulu-Natal.

- Reinstatement premiums of R69m were incurred in the first six months of 2023 in respect of large claims compared to R50m in 2022 (excluding the KZN floods).

- Covid-19-related contingent business interruption (CBI) reserves of R155m were released in the first half of 2023, compared to R397m in the comparable period. The claims to date have been lower than the initial estimates.

Santam estimated its gross liability for open CBI claims at the end of June as R535m (December 2022: R1bn), with a corresponding reinsurance asset of R519m (December 2022: R900m). It expected most of the remaining claims to be settled by the end of 2023.

Underwriting actions

Santam described 2022 as “a perfect storm” when it announced its annual financial results. The period was characterised by low economic growth and high unemployment, persistent rainfall, severe flooding in KZN, elevated claims inflation, and an increase in claims related to power surges, fires, and crime.

It said some of these conditions will not dissipate soon, and the first half of 2023 has presented several challenges.

The prospects for growth in South Africa’s “highly competitive insurance market” remain poor because of pressure on consumers’ disposable income from high inflation and rising interest rates, it said.

The cost of reinsurance has increased “substantially” following the significant losses experienced globally and in South Africa since 2020.

The group said it implemented several underwriting actions in response to the 2022 claims experience, including enhanced risk assessments, premium increases in certain segments, changes to excesses, and enhanced security requirements for high-risk vehicles.

“These actions are yielding positive results, with a marked turnaround in the profitability of the motor book and a decline in power surge losses. We believe that power surge cover is an insurable peril and an important value proposition for our clients,” Santam said.

Chief financial officer Wikus Olivier said Santam was seeing the benefits of “encouraging” its clients to fit tracking devices to their vehicles.

The group has seen a significant reduction in the number of thefts, notably since the second half of last year, and a marked increase in the number of recoveries, particularly involving high-end vehicles, Olivier said.

Santam’s property class of business, which remained unprofitable in the first half because of high claims, “continues to receive particular attention”.

Despite an increase in premiums, recent weather- and fire-related claims indicate that clients’ premiums and risk mitigation “are not yet sustainable”, it said.

Geocoding initiative

Santam said it will prioritise the deployment of geocoding to minimise losses stemming from adverse weather conditions. Its geocoding initiative aims to create a comprehensive risk-based view of property locations in South Africa.

Geocoding provides a set of co-ordinates for each address, so the insurer can locate each insured building and its proximity to various peril zones. The technology also enables experts to map and analyse climate data, to identify areas that are particularly susceptible to the effects of climate change.

Santam uses the information it gathers from geocoding to take mitigating actions, either to exclude policies or work with property developers and town planners on where it is best to build.

Despite the geocoding programme being in the implementation phase, with about 50% of properties covered to date, Santam said the risk-mitigation actions it took in response to the initiative prevented losses of about R55m during the recent floods in the Western Cape.

Santam group chief executive Tavaziva Madzing said one of the focus areas for the company was to expand the use of the technology.

“We are seeing there is no let-up to catastrophes around the world. Currently, we are seeing that natural disasters are starting to reach about 100 million people per year. What that means is that we need to be more nuanced about how we take on risk, particularly in the public class of business,” he said.

Madzinga expressed concern about the increase in the frequency and size of fire claims, which were partly because of “challenges in firefighting infrastructure”.

“We are finding that with the increase in weather-related events and exposure to large losses from fires, we are spending a lot more time trying to understand the key drivers […] Where are those properties located, how close are they to fire stations, firefighting capability, what’s the extent of maintenance within those buildings, and just making sure we are able to price properties adequately.”

New operating model

Santam said it also responded to the challenging environment by launching its refreshed FutureFit strategy at the end of 2022, going live with a new multi-channel operating model on 1 January 2023.

The Commercial & Personal multi-channel business was restructured into three business units to focus on the distribution channels where the group interacts directly with clients (Client Solutions), through brokers (Broker Solutions), and partnerships (Partnership Solutions). Its other client-facing businesses are MiWay, Specialist Solutions, and Santam Re.

“Although at an early stage of implementation, the new operating model provided immediate focus that enabled us to weather the challenges and improve on our performance for the comparable period in 2022, Santam said.

“Our new six business segments allow us to focus on different parts of the market, focus on SMEs, focus on the emerging younger consumers,” Madzinga said.

Santam said its partnerships with MTN and the Sanlam Group could also allow it to acquire new clients.

Santam has bought MTN’s device insurance book in South Africa. The transaction is part of a broader strategic alliance between Sanlam and MTN through aYo Holdings, the MTN Group’s insurtech platform.

Santam started writing new device insurance business through this arrangement in April 2023. “Initial sales volumes are very promising,” it said.

The transfer of the in-force book of business, which will add some 400 000 policies to the Santam licence and annual gross written premiums of nearly R400m, is subject to regulatory approval, which is expected during the third quarter of 2023.

It said the acquisition of the device book will also provide a platform to expand the product range beyond device insurance.

Extracting value through closer collaboration with the Sanlam Group was a key focus area – in particular, via cross-selling into Sanlam’s much larger client base.