The ominous rumblings of climate change have reached the insurance industry’s doorstep, and the forecast is troubling. This is the view of Ronald Richman, the chief actuary at Old Mutual Insure, who says that globally, weather-related events are threatening to cause an insurance crisis; in South Africa, insurers are bracing for its impact.

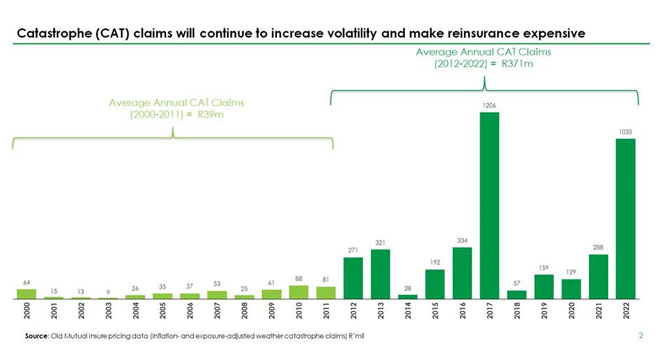

“While the country used to be a Catastrophic Event (CAT) free zone, the scale and magnitude at which disasters have taken place recently means we are now experiencing a dramatic shift in the CAT landscape,” says Richman.

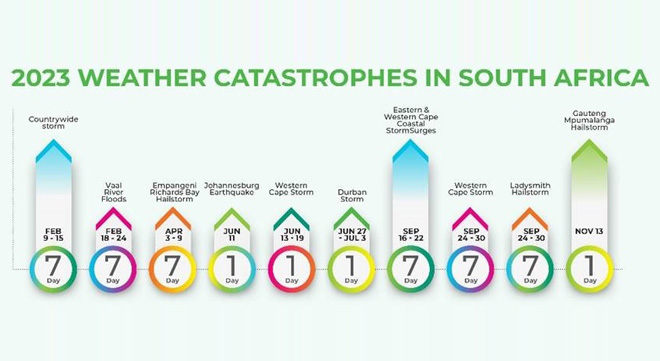

In 2023, Old Mutual Insure recorded 10 weather-related claims events, of which three were significant, running into millions of rands. These were the Western Cape storms in June and then again on the Heritage Day weekend in September, as well as the Gauteng and Mpumalanga hailstorm in November 2023.

This is not a phenomenon unique to South Africa: globally, severe weather is impacting the sustainability of the insurance industry in new and unexpected ways.

Across the world, Richman says, data shows that severe convective storms were predominantly responsible for CAT losses, accounting for 68% of global insured natural catastrophe losses in the first half of 2023. Severe thunderstorms in the United States led to $34 billion in insured losses, some 70% of total insured CAT losses, during the same period, an unprecedented level of financial damage in such a short time, according to Swiss Re Group’s Sigma publications.

Whereas large single events, such as hurricanes or earthquakes, have often been the driver of record CAT losses in previous years, data from 2023 suggests that smaller events were the main issue during 2023. This was likewise the case in the South African environment.

In addition, 2023 was the hottest year on record, with scorching temperatures driven by climate change and further amplified by El Niño, a naturally occurring climate phenomenon that takes place every two to seven years, and other cyclical weather phenomena.

In 2023, some experts said the US economy was overexposed to climate risk in the same way that it was overexposed to mortgage risk in 2008, a major cause of the catastrophic financial crisis at the time.

“Given this picture, it is not far-fetched to believe that climate change has the potential to destabilise the global insurance industry, with ripple effects for South Africa,” says Richman.

Signs of stress are already emerging in several parts of the US, with companies withdrawing coverage from California and Florida.

Reinsurance market is hardening

Structural changes in the reinsurance market have compounded the challenges.

“While many of the recent events have not been unprecedented, insurers have experienced them as particularly acute losses hitting their bottom lines and capital reserves. This is due to reinsurers taking significantly less risk from these types of events, leaving insurers unable to smooth out the losses over time,” says Richman.

In 2023, according to research undertaken by PwC, reinsurers again ranked climate change as the most significant risk facing the sector. According to Moody’s, reinsurers are feeling the pinch as they accumulate losses from customer-facing insurance companies. To counter this, many are raising prices, limiting coverage, and even exiting some markets to improve returns.

“This structural shift in the reinsurance market has far-reaching implications, demanding a fundamental re-evaluation of how the market approaches risk and pricing,” says Richman, emphasising that contrary to popular belief, profit margins in the traditional lines of business in the non-life insurance industry are slim. “This, together with the convergence of inflationary pressures and losses from CAT events, means that we are in a pressure pot, ready to bubble over.”

He says that for insurance to be sustainable, the right price must be charged for cover that reflects the true cost of risk in the current volatile climate.

“Otherwise, you jeopardise the trust placed in the insurance system to be there when things fall apart,” says Richman. “To fund the level of coverage policyholders have previously enjoyed, price increases will be necessary over time to account for these losses and need to be done in a manner that reflects the true risk posed by each policy.”

He adds it is not all bad news, as sophisticated modelling techniques and innovative solutions are being explored to better quantify the rising climate risks. These should help in navigating these turbulent waters.

Earlier in 2024, Old Mutual Insure announced an innovative new approach to capturing climate change data and aligning this with the insurance policy experience to help close the gap between the prediction and pricing of weather-related risks. It is the first project of its kind in South Africa to overlay climate-data with claims-data.

Read: Old Mutual Insure teams up with UK flood specialist to tackle rising climate threats

What should be done

“Mitigation efforts are essential. Education is key, as consumers must understand the importance of risk management and asset protection against climate change,” says Richman.

“In addition, public-private partnerships can help address underinsurance in the South African market and spread risk more equitably. Currently, there isn’t a structure for this type of solution, unlike in other parts of the world where it has been introduced successfully.”

He points to Flood Re, which is a flood re-insurance scheme in the UK – a joint initiative between the government and insurers to make flood cover more affordable.

“In South Africa, where structural deficiencies exacerbate the disparity between the insured and the uninsured, a similar approach is warranted.

“The insurance industry in South Africa has the breadth and depth of knowledge and skill, coupled with a desire to help, and be a solution to the problem. Ultimately, this would ease the burden of these events on all stakeholders in South Africa,” says Richman.