The war in Ukraine is having a significant effect on inflation and activity in the world economy as commodity prices have soared and supply chains have been disrupted. Inflation in the G7 was running at more than 7% in April, its highest for 40 years, and will reach double digits in some countries, such as the UK, later this year.

The conflict also marks a watershed moment because it challenges established assumptions about the balance of geopolitical power in the world economy. This has implications for future alliances, trade and investment.

In our view, the consequences of Russia’s invasion of Ukraine will reverberate for many years and will act as a further disruptive force on the world economy.

In this note, we look at how the war could lead to a realignment of global powers and a more regionalised world economy with implications for global supply chains and inflation.

Beyond Russia’s invasion of Ukraine: a new world order?

Although important in energy markets, Russia accounts for only 2% of global trade. It plays a relatively minor role in international investment and global supply chains or value chains (GVCs). At face value, the impact of the war and sanctions would not seem to be a threat to overall globalisation.

However, the invasion of Ukraine has demonstrated the power of sanctions. It’s also opened up a divide between those nations that oppose the war and support Ukraine and others that are with Russia. There is also a large group of countries that are taking a more neutral position and may at some point be pressed into choosing sides.

In effect, the war has opened a fault line between nations and will influence behaviour and investment going forward. Companies are now more aware of the political risks and costs associated with trade and foreign direct investment (FDI).

One of the first lessons from the Ukraine conflict has been the power of sanctions to isolate an economy from the global financial system. Russia thought it was well prepared but found that its war chest of $600 billion in foreign exchange reserves ineffective. Access to them has been stymied in the face of sanctions, such as exclusion from the Swift system, which is integral to making international payments.

Alongside the outcry from public opinion, such sanctions have meant Western companies have had to write off significant investment in Russia since the war began. Estimates from the United Nations Conference on Trade and Development suggest that two-thirds of the Russian FDI stock is held by companies domiciled in developed-market countries opposed to the war. The top 10 holdings by multi-national companies amount to $105 billion, much of which has been written off.

Ignoring political risks can be expensive but identifying them in advance is never straightforward. One approach is to look at how countries vote in international forums. For example, the recent United Nations vote to expel Russia from the Human Rights Council provides some clues as to where future alignments may lie.

The necessary two-thirds majority to expel Russia was achieved, with strong backing from the West, particularly the 30 Nato countries. However, there were some notable abstentions, such as India, Brazil, South Africa, Indonesia, Mexico, Saudi Arabia and other nations from the Middle East.

Meanwhile, Russia, China, Cuba, North Korea, Iran, Syria and Vietnam were among the 24 countries that voted against.

China and the risks of broader sanctions

Clearly, China stands out among the dissenters. The world’s second-largest economy, it accounted for 18% of global merchandise exports in 2021, the highest for a single country, according to the World Trade Organization (WTO). China has also attracted considerable FDI as companies seek direct exposure to the Chinese market. In 2021, it was the second-largest recipient and the fourth-largest source of FDI.

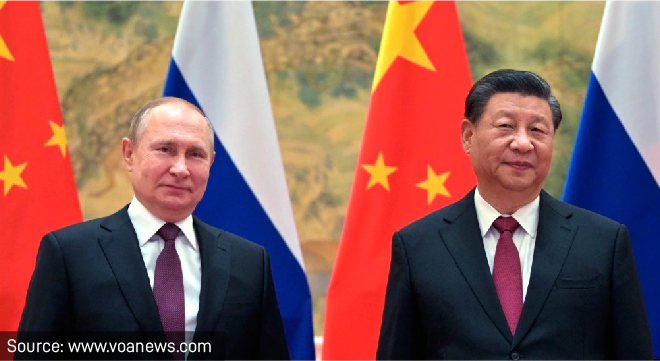

United by a mistrust of Western institutions and particularly Nato, Russia and China have formed an alliance that has “no limits”, indicating scope for broad-based co-operation.

From an economic perspective, the two are complementary, as Russia seeks more sophisticated technology and China is very commodity-dependent. It may also be possible to trade the Chinese yuan against the Russian ruble outside of Swift and free of Western sanctions.

So far, China has been careful in what it says about the Ukraine crisis, and at this stage there has been no acceleration in trade with Russia. As the friendship develops, however, there is a risk that support for, or even a lack of opposition to, Russia will be interpreted in a hostile way and ultimately attract sanctions from the West.

One potential flash-point is in energy markets, where sales of gas and oil have been critical in funding the Russian military. As a consequence of sanctions, there is a significant discount on Russian oil, currently $25/barrel, which offers a substantial saving on energy costs and a competitive advantage for those economies that are prepared to buy it.

Some of that discount is eroded by refining and insurance costs, but with the EU and US set to embargo Russian oil, the saving on Urals crude is expected to persist.

The discount has already proved sufficiently attractive for India. It has become a significant importer of Russian oil, increasing its share of the country’s exports to 18% from 1% before the conflict in Ukraine. India and China now account for about half of Russia’s marine-bound oil exports.

Consequently, we can expect tensions to build, and it will not be long before we hear a call for tariffs or other measures on those supporting Russia through trade. Such action could be seen as being in the same vein as the EU plan to impose carbon tariffs on imported goods that are heavily reliant on burning fossil fuels. Russian aggression, rather than climate change, would be the target, but the measures would be the same.

China’s relations with the West: a balancing act

Before we go too far along this path, however, we should remember that China will try to strike a balance. China’s prosperity is based on international trade, mostly with the West. The US-China trade route is still the busiest in the world, and increased trade with Russia cannot compensate for the potential loss of US or EU business.

Meanwhile, the West is well aware that the growth in China trade has been one of the major drivers of globalisation. The increased supply of low-cost Chinese goods has played a key part in suppressing inflation and, by raising global labour supply, putting downward pressure on wage costs in the developed markets.

If the West extends sanctions to those nations seen as supporting Russia and prolonging the conflict in Ukraine, global growth would be weaker as international trade slows. China would be badly affected and would struggle to counter the loss of US and European trade. However, the impact would also be felt in the West through faster global inflation and an even greater cost of living crisis.

Such a stagflationary outcome means that mutual interests in the global trade system are likely to prevail, and both sides will tread carefully to avoid an escalation in tensions over Russia.

Another blow to globalisation

Nonetheless, the conflict in Ukraine clearly sets the stage for an increase in geopolitical tension as a new world order emerges. In this respect, the risks have risen and hence deal another blow to the globalised model of extended supply chains. When making decisions over where to locate production, multi-national companies will be weighing the risk of adverse political outcomes against the benefits of more efficient operations.

That model has, of course, already come under strain from Brexit, US trade wars with China, and the Covid-19 pandemic.

The latter exposed the weakness of far-flung supply chains and remains an issue as China’s zero-Covid policy continues to delay deliveries. The trade war between the US and China has also injected a degree of caution. Tariffs and restrictions on technology have increased such that FDI into China has slowed.

For the UK, Brexit has caused major disruption in supply chains as international firms grapple with the complexities of producing goods across different trade jurisdictions.

Meanwhile, climate change acts as a continuing threat in the background, with the potential to disrupt supply routes and production facilities.

Not surprisingly, “just in case” is replacing “just in time” as the guiding principle for firms seeking to make their supply chains more resilient.

Options for future trade

This presents several options. We may see increasing capital flows into other “friendly” lower-risk countries as alternative locations for FDI. Companies may hold more inventory, there may be more onshoring of overseas production, or simply less output as the extra risks deter expansion.

1. Increased FDI to lower-risk countries

The first of these options would be preferred from an economic perspective because it would sustain global trade, albeit on a more regional basis. Estimates from the McKinsey Global Institute suggest that 15% to 25% of global goods trade could shift to different countries over the next five years. The result would be that a broader set of countries will participate in GVCs in the years ahead. Our earlier analysis on US-China decoupling also provides some scenarios.

Alongside this we are likely to see a simplification of production processes as has been apparent in the reduction in semi-conductor chips in the auto industry and greater standardisation, such that inputs can be sourced from a wider group of suppliers.

The result may be a departure from the optimal allocation of capital, but efficiency losses would be minimised. In effect, supply chains could become simpler and more diversified, an outcome acceptable to economists and risk managers alike.

2. Companies holding more inventory

Increasing inventory is probably the most obvious: building buffer stocks into the supply chain. This would be a reversal of the more efficient just in time model that helped to drive significant declines in the inventory-sales ratio in the first decade of the century. These declines occurred between China’s ascension to the WTO and the global financial crisis (GFC).

However, judging from recent trends in the US, there has already been some increase in inventory-sales ratios in recent years and prior to Covid. This may not reflect the broader international picture, but it could be attributed to low interest rates after the GFC, which reduce the cost of funding inventory.

Going forward, inventory is likely to rise given its low cyclical position and as firms choose to hold greater stocks in the long run to guard against disruption, but higher interest rates may temper this move.

3. More onshoring of overseas production

The third option of more onshoring through bringing supply chains home would boost domestic activity but clearly represents a retreat from globalisation.

The supply chain may become more robust and resilient to global shocks, but security comes at a price. For example, moving production from Asia back to Europe can be expensive. Although the ratio of workers’ wages in the US compared to China has fallen from over 30 in 2000, it was still five times in 2018 (the latest figures available).

The increase in transport costs (shipping and fuel) helps offset this, but higher labour costs mean that increased onshoring will come alongside greater investment in robotics and artificial intelligence. Higher productivity will have to stay competitive.

4. Less investment, less output

The fourth outcome is the worst outcome because it would simply mean less trade, weaker growth and lower income.

In practice, we will probably see a mix of all four options: diversification of supply chains to “safer” countries, more inventory and onshoring, and some withdrawal from international trade.

Stagflation as the risk premium on globalisation rises

What does this mean for investors? The reverberations from Russia’s war with Ukraine point to a new alignment of nations. Tensions over the war are likely to lead to a more fragmented or regionalised world economy.

In macro terms, this means less efficiency, higher costs and slower growth – in other words, more stagflation. Global supply will be more disrupted, and in this respect, inflation will be harder to control. The challenge for central banks in keeping inflation to target will be greater, making interest rates higher and more volatile.

There will be bright spots as the search for greater security of supply should encourage greater adoption of technology. Firms will need to counter higher costs through higher productivity. Wages should be stronger as a result, although overall global employment would be lower, particularly in the emerging markets.

The war in Ukraine will intensify the focus on the risks of globalisation and raises geopolitics up the agenda for business and investors. Trade and investment help bind countries together, but when they unravel, the costs are significant.

Keith Wade is chief economist and strategist at Schroders.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies.