There really is no such thing as a dormant company. Even if a company ceases to trade or receive income, including income that originates from investments, it still has statutory obligations, which include filing tax returns.

A failure to file tax returns may result in administrative penalties, and the directors may even be held personally liable for the penalties.

Formalising dormancy

There is a misconception that an entity is automatically precluded from taking steps from taking steps to formalise its dormancy once it ceases to trade for whatever reason, says Jean-Louis Nel, tax director at Van Huyssteens Commercial Attorneys.

An entity can formalise its dormancy by way of a liquidation process, when there are still assets and creditors, or deregistration with the Companies and Intellectual Property Commission, when there are no assets or outstanding creditors, says Nel.

Jean du Toit, a tax director at the same firm, says the barrier to incorporating a company is low. “The decision to establish this juristic entity is fairly uninvolved, which often results in it going unused.”

A trading entity may become dormant for financial reasons or because of unanticipated circumstances, but generally this will result in a formal liquidation process because there are assets to unlock and creditors, including the South African Revenue Service (Sars), to pay.

Once the dormancy has been formalised, Sars must be notified. The company must deregister for all the tax types for which it was registered, such as income tax, value-added tax, Pay-As-You-Earn, and customs and excise.

Threshold for filing returns

An entity that has failed to “extinguish its existence as a legal juristic person” and submit tax returns may be in for a nasty surprise.

The threshold for filing tax returns is low. If a company retains assets or incurs a loss, the obligation to file a return remains, Du Toit says.

In terms of the latest public notice from Sars, resident companies must file returns when they:

- Derived a gross income of more than R1 000;

- Held assets that cost more than R1 000 or had liabilities of more than R1 000;

- Derived a capital gain of more than R1,000; or

- Had any taxable income, turnover or assessed loss.

A failure to submit a tax return may attract penalties. In the case of a dormant entity that has not generated any taxable income, the maximum penalty that may be imposed is R250.

Tax specialist Neill Hobbs, the chief executive of Hobbs Sinclair, says if a dormant company is behind with submitting tax returns, Sars will impose a penalty based on the most recent tax return received.

“The best-case scenario is a penalty of R250 per month, even if the company has not made a profit or has an assessed loss. The penalty is back-dated and accumulative,” he warns.

Penalty regime

In terms of the Tax Administration Act (TAA), Sars is limited to imposing the monthly penalty of R250 for 35 months from the date on which the assessment was due.

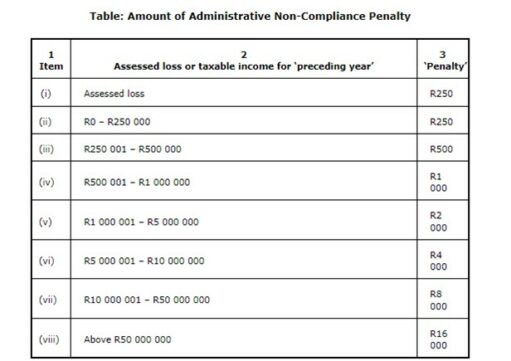

However, warns Du Toit, companies that are not dormant and have a higher taxable income can expect a higher nominal monthly penalty. This penalty is directly related to the level of income.

Although Sars may not impose penalties for non-compliance beyond 35 months, it is permitted to take further steps against the taxpayer to recover the penalty amount, says Nel. These steps may include:

- Applying for the liquidation of the taxpayer;

- Obtaining a civil judgment against the taxpayer;

- Attaching the taxpayer’s bank account; or

- Holding the financial management of the taxpayer liable.

The best way to avoid penalties is to formalise the dormancy by deregistering the entity or liquidating it.

Directors’ liability

Directors have a fiduciary duty to manage a company’s affairs and finances with care. The TAA holds the representative taxpayer and public officer of a company personally liable for its tax compliance.

Du Toit says although this person is normally appointed by the company, Sars may designate one of the directors if no one was appointed.

“These persons carry a level of personal liability for the company’s compliance with tax legislation. Where there is negligence in the financial management of the company, the directors can be held personally liable for the tax debts of the company.”

It is important to ascertain the company’s tax compliance status on the company’s tax profile and to rectify any defaults, otherwise even the most minor debts may cause difficulty.

“The situation is more serious where the company’s dormancy or cessation of trading occurs as a result of negligence or fraud on behalf of the directors,” Du Toit says.

Amanda Visser is a freelance journalist who specialises in tax and has written about trade law, competition law and regulatory issues.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies.

Is it possible for you to provide me with a link to, or documentation from SARS regarding this?

Amanda Visser has provided the following link: https://www.sars.gov.za/wp-content/uploads/Legal/SecLegis/LAPD-LSec-TAdm-PN-2022-01-Notice-2130-GG-46471-Notice-to-furnish-returns-2022-3-June-2022.pdf

What are the responsibilities of an Executor where the deceased was the only shareholder and Director?

Link to any documentation would be appreciated.

Some Executors choose to not get involved with that. Especially where tyhe entity was de-registered at CIPC for non-submission of Annual Returns.

This means the entity will never be de-registered at SARS.

I registered a company in 2020 that is now Dormant as per the SARS statement. The business never traded, or had any income or assets. How do I close this business, so I do not have to submit SARS yearly?

Good day. We have just published an article that may answer your questions: https://www.moonstone.co.za/considerations-when-deciding-whether-to-keep-a-company-dormant-or-close-it/