Professional services company PwC, in collaboration with DataEQ, has released its latest report measuring consumer sentiment towards 15 of South Africa’s major insurers.

The report aims to present the sentiments of consumers in relation to their experiences with claims-handling and insurance staff, and their views on short- and long-term insurance products. The report also analyses the social responsibility and market conduct of the insurance industry against the Treating Customers Fairly framework.

This year’s Insurance Sentiment Index tracked more than 530 000 public posts across X (formerly Twitter), Hellopeter, and other online sources from 1 April 2022 to 31 March 2023. These posts were processed using DataEQ’s Crowd and AI technology.

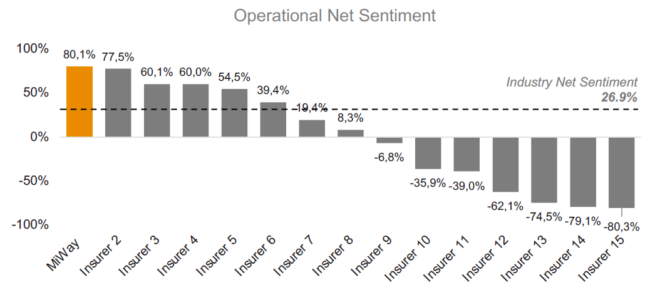

PwC says that one of the highlights of this year’s report is the dramatic improvement in customer service sentiment, which rebounded from negative 68.1% Net Sentiment in 2022 to positive 25.3%. The reasons for the swing included increased praise for staff on Hellopeter because of the efforts insurers have made to improve online responsiveness.

Satisfied customers often mentioned rapid and helpful responses from staff, including times when they were called back when their line dropped or their airtime ran out. Others highlighted the smooth claims process, with claims paid out quickly and without hassles.

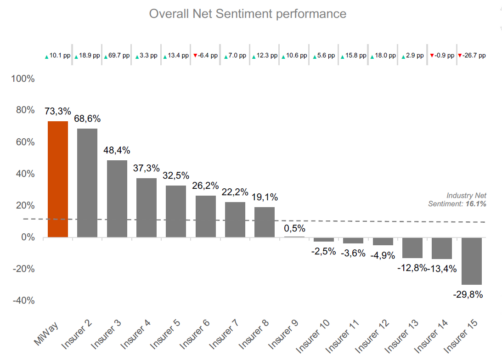

The insurance industry has experienced three consecutive years of Net Sentiment increases, rising from 0.4% in 2021 and 6.8% in 2022 to 16.1% Net Sentiment in 2023. This is far higher than the banking (9.4%), retail (3.3%), and telecommunications (-14.0%) sectors in 2023.

Eight insurers performed above the aggregate Net Sentiment of 16.1%, while three insurers experienced a decline in their Net Sentiment from the previous year.

Recurring themes within the drivers of negative sentiment were customers venting their frustrations over delayed payouts, poor customer service, and billing issues. Unauthorised deductions and difficulties with the claims process led to concerns about a lack of transparency in both the sales process and the ongoing management of insurance products.

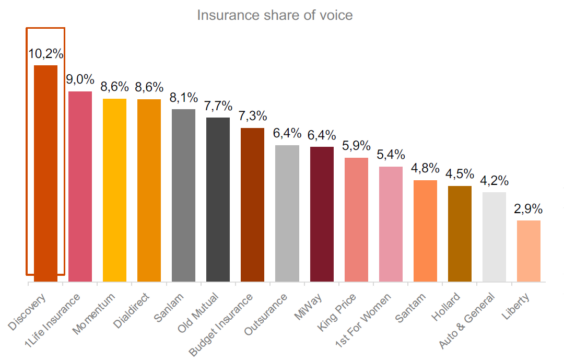

Discovery dominates the online conversation

Discovery held the largest share of the online insurance conversation, with 10.2%. Although the data in the report was cleaned to exclude overt mentions of Discovery’s banking, investments, and medical scheme services, general mentions of the brand were included, which contributed to Discovery’s high share of “voice”.

MiWay keeps its top spot

As in 2022, MiWay recorded the highest Net Sentiment among individual insurance providers in 2023 – rising 10.1 percentage points to reach 73.3%. Consumer praise for staff on Hellopeter and the insurer’s educational marketing campaigns were key contributing factors to MiWay’s performance, the report says.

Hellopeter’s key role in shaping perceptions

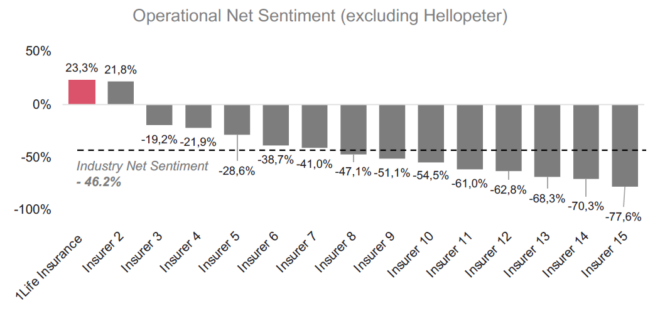

Hellopeter had a major influence on operational sentiment within the insurance industry. Excluding Hellopeter data would have drastically altered the industry scores, particularly operational Net Sentiment, which would have decreased from 26.9% to -46.2%.

In 2021, only 10.8% of insurance-related conversations took place on Hellopeter. This figure grew to 15.9% in 2022 and climbed again to 22% in 2023, demonstrating a trend of consumers’ increasing use of Hellopeter to engage with insurers.

Interestingly, as Hellopeter conversations increased, so did the industry’s Net Sentiment. This suggests that insurance companies may be encouraging customers to leave positive reviews on Hellopeter. However, people are unlikely to compliment services with which they are not happy, so the rise in positive reviews likely reflects a real improvement in customer satisfaction.

1life Insurance relied the least on Hellopeter for positive sentiment, with most conversation on X. The insurer drove positive sentiment through its #WinningWednesday weekly competition series.

Net Sentiment for the claims process dropped since last year

Claims continued as a pain-point for customers. In 2021, the claims process had a Net Sentiment of -57.1%. In 2022, it was -35.8%, but this year it dropped again to -48.7%.

MiWay was the exception – it was the only insurer to receive a positive claims process Net Sentiment, of 16.7%, largely influenced by Hellopeter reviews.

The largest and most negative topic was the status of claims. Clients complained about having to constantly follow up on claims that had been lodged or were in the process of being lodged.

Customers expressed frustration with not knowing whether their claim had been finalised. They accused insurers of employing delay tactics to prevent claims from being processed, such as constantly asking for different documentation, dealing with multiple staff members, staff providing conflicting feedback, or avoiding communication. Some customers questioned why they should continue paying premiums when their cases are being investigated or delayed.

Many customers felt dissatisfied with the reasons provided for rejected claims, specifically when they were not stated on policy documents. Customers felt that insurers would look for any reason not to pay a claim, some of which seemed unreasonable to customers.

Another common issue was claims being rejected based on account/admin issues. In these cases, customers questioned why their insurers only brought up these issues at the point of claims and were not proactive in communicating them before.

Sentiment towards insurance categories

The volume of conversation around short-term insurance outweighs that around long-term insurance, with a ratio of 64.2% to 35.8%, respectively.

Although both insurance categories showed negative Net Sentiment, short-term insurance fared better, registering a Net Sentiment of -22.4%, while long-term insurance came in at -61.2%.

MiWay was an outlier within short-term insurance. The brand had an impressive Net Sentiment of 51.7%. The source of this positive sentiment came primarily from Hellopeter, with many compliments for MiWay’s vehicle and roadside assistance services.

Only two insurance categories had positive Net Sentiment ratings: emergency services at 50%, and roadside assistance at 35.2%.

Vehicle insurance, the most frequently discussed category, measured a Net Sentiment of -15.6%. Although positive sentiments emerged from aspects such as staff assistance, affordable monthly fees, and overall cost-effectiveness, the topic also saw negativity mainly because of issues concerning turnaround time and perceptions of poor staff performance.

Household content insurance registered a negative Net Sentiment of -27.5%. Turnaround time and staff appeared as recurring themes in negative conversations. Positive mentions focused on affordable monthly fees and staff interactions.

Life insurance saw negative Net Sentiment of -59%. Negativity was largely fuelled by regulatory concerns because of the Competition Commission’s “price-fixing” raids on several insurance companies. Positive sentiment stemmed from customer referrals and affordability.

Funeral cover registered -56.4% Net Sentiment, which largely originated from issues related to turnaround time, claim processing, and staff interactions. Positive conversation centred on customer referrals, quotes, and overall pricing structure.

Property insurance was significantly negative, with a Net Sentiment of -78%. Frustrated consumers were primarily searching for answers to the status of claims, an area warranting attention and improved communication from several brands. Despite this, some consumers responded positively to good staff interactions and efficient turnaround times.

The income protection and disability insurance categories registered the lowest Net Sentiment, with income protection at -95.6% and disability cover at -97.5%. Effectively, all mentions in these categories were negative, with rejected claims as the main concern.

Would be nice if they did a spellcheck before submitting a report for public scrutiny.