Retirement fund administrators may enjoy a “windfall” of some R500 million to R1 billion a year from the fees they charge on savings component withdrawals, according to a report by Keystone Actuarial Solutions.

The two-pot retirement system, which took effect this week, gives fund members the option of withdrawing some or all the money in their savings component once per tax year if they have at least R2 000 available to withdraw.

Howard Buck and Grant Base, who are consulting actuaries at Keystone, say the advent of savings component withdrawals represents a significant change for administrators. Historically, they paid benefits (other than in respect of divorce and maintenance orders) only when members left their funds. Under the two-pot system, administrators will pay benefits while the member remains a member of the fund.

Buck and Base believe it is possible that savings component withdrawals will result in the number of claims payments being as much as four or five times higher than the normal (pre-two pots) number of annual payments.

Administrators have had to change their systems to be able to administer member benefits within the various components, verify the identity of the member requesting a savings component withdrawal, process the request, and effect the payment. Administrators have incurred significant costs in developing and updating their systems and processes for the two-pot system.

As a result, most administrators have decided to charge a fee for each savings component withdrawal or increase their basic administration fee, or a combination of the two, Buck and Base say.

Savings component withdrawal fees

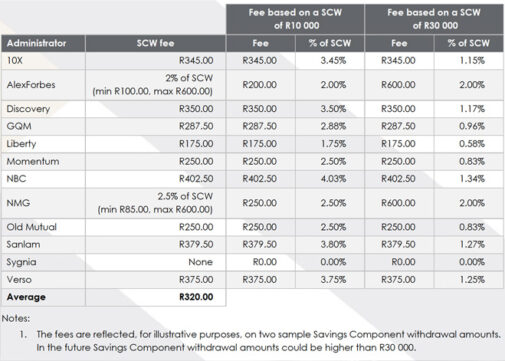

To help funds understand the competitiveness of the fees their administrator is charging, Keystone conducted a survey of medium and large commercial retirement fund administrators to determine the fees they will charge (including VAT where applicable) in respect of the two-pot system.

The fees for savings component withdrawals are summarised in the table below. Administrators that either failed to respond or asked to be excluded from the survey are not in the table:

Notes:

- The fees illustrate what will be paid for two sample savings component withdrawal amounts, R10 000 and R30 000. In future, the withdrawal amounts could be higher than R30 000.

- Where administrators manage stand-alone and umbrella funds, they appear to be charging the same fee under both arrangements.

- The table excludes the fees charged for withdrawals from retirement annuity funds and preservation funds.

- Discovery will deduct the fee from the member’s components after the withdrawal and not from the savings component withdrawal itself. All the other administrators will deduct the fee from the savings component withdrawal.

- GQM and Momentum will charge an additional R115 and R100, respectively, if the savings component withdrawal requires manual intervention by the administrator.

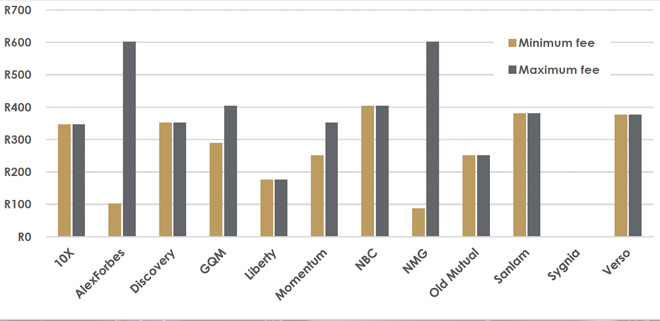

Keystone also provided the minimum and maximum savings component withdrawal fees that will be charged by each administrator:

Most of the administrators surveyed are charging a flat fee irrespective of the value of the savings component withdrawal, while two administrations are charging a scaled fee depending on the value of the withdrawal. Their average fee will depend on the profile of the actual savings component withdrawals of their respective administration books but is likely to be in the same range as the flat fee for the other administrators, Buck and Base say.

Base fee increases

Three administrators confirmed they will increase their base administration fee by between 2.8% and 4% on 1 September because of the implementation of the two-pot system.

The other administrators confirmed that their administration fees will not increase on 1 September, but several said they may increase their fee at the next fee review date once the actual profile and number of savings component withdrawals are known, Buck and Base say.

Expected fee earnings

The profile of Savings Component withdrawals by amount and by administrator is not known at this stage, but based on reasonable assumptions, Keystone believes it may average out at a fee of about R320 per withdrawal.

Based on an average assumed savings component withdrawal of, say, R20 000, the fee will be an average of 1.6% of the amount withdrawn.

Most estimates of the total expected initial savings component withdrawals are between R50bn and R100bn. Based on these estimates and excluding estimated withdrawals by members of the Government Employees Pension Fund, Buck and Base say the savings component withdrawal fees that could be paid to administrators in the part tax year from 1 September 2024 to 29 February 2025 could be between R640m and R1.25bn. These amounts exclude any fees as a result of the increase in the base administration fee.

They say the number and value of savings component withdrawals in future tax years will depend on how quickly members’ savings components rebuild. One-third of contributions will be allocated to savings components after 1 September 2024.

Assuming that most of the members who take a savings component withdrawal shortly after 1 September 2024 take a further withdrawal in each subsequent tax year, administrators could earn some R500m to R1bn every year from savings component withdrawal fees. “This will represent a material windfall to the administrators and a consequent reduction to member benefits,” Buck and Base say.

“We would hope that all the administrators, once they have recovered any initial expenses of implementing the two-pot system, assess their ongoing costs and, if applicable, adjust their savings component withdrawal fees appropriately.”

Just a quick FYI – The information is not correct in at least one instance. Sygnia sent out a note explaining their charges. A snippet of which is:

How to withdraw from your savings component

To submit a withdrawal from your savings component, please complete the ‘Savings Component Withdrawal’ form and submit your completed form along with the relevant supporting documentation to instructions@sfs.sygnia.co.za. This form will be available on our website and will also be available for download via your secure Alchemy online portal from the beginning of September. To ensure your benefit is taxed correctly, a valid tax number and annual salary amount are compulsory requirements.

Transaction fee for savings component withdrawals

We will apply a transaction fee for each savings component withdrawal as follows:

2% ex-VAT of the gross savings component withdrawal amount, subject to a

•

Minimum of R100 ex-VAT, and a

•

Maximum of R600 ex-VAT

I received the same communication. The fees in the communication apply to Sygnia’s RA and preservation funds. The results in the table exclude these funds (note 3). Keystone asked Sygnia to confirm that the information in the table was correct prior to publishing the results.

This afternoon, 5 September 2024, Sygnia confirmed the following to Keystone: “SURF (Sygnia Umbrella Retirement Fund) is not charging any two-pot fees. Our retail division (RA/Pres Fund) is charging fees for two-pot withdrawals.”

I see that now. Thanks for the clarification. Retail investors with Sygnia may be forgiven for being less than enthusiastic about the differentiation.

Will there not be a SARS withdrawal tax applied ?

Yes, SARS will tax the withdrawals at the member’s marginal rate.