The Ombudsman for Long-term Insurance (Olti) released its annual report for 2022 this week. Here are 10 key take-aways from the report:

1. Decline in requests for assistance

The Olti received 16 476 written requests for assistance in 2022, a decrease of 5.1% from the record of 17 379 requests set in 2021. However, this was still higher than the 14 198 requests in 2020.

The Olti said the decrease was not surprising because the brunt of Covid-19-related claims was felt in 2021.

2. Chargeable complaints decrease by 12.7%

Of the 16 476 requests for assistance, 7 126 were translated into chargeable complaints (the Olti charged a case fee), a decrease of 12.7% from 2021.

Chargeable complaints are categorised as:

- Mini Cases: simple complaints within the Olti’s jurisdiction but which insurers can handle without the office’s involvement. The were 231 (2021: 284) mini cases last year.

- Transfers: complaints referred to insurers to try to resolve them directly with the complainant. If not resolved and if the complainant requests the Olti to do so, they are taken up as Reviews and handled in the same manner as Full Cases. Transfers decreased to 5 506 from 6 038 in 2021. Insurers settled 1 666 (30%) of these Transfers compared to 1 775 in 2021. Reviews decreased to 1 207 from 1 677 in 2021.

- Full Cases: complaints that have already been seen by insurers, and they are handled by the office from inception to finalisation. There was 25% decrease in Full Cases, from 1 841 in 2021 to 1 389 last year.

The number of complaints to the Olti should be seen in context of the number of in-force policies.

According to statistics provided by the Association for Savings and Investment South Africa in September last year, there were 34.2 million in-force recurring-premium risk policies (life, funeral, credit life, disability, severe illness, and income protection) and 5.96 million in-force recurring-premium savings policies (endowments and retirement annuities) at the end of June 2022.

Therefore, the 7 126 chargeable complaints dealt with by the Olti did not constitute even 0.1% of the total number of in-force policies.

3. Fewer cases resolved in favour of consumers

The percentage of cases resolved wholly or partially in favour of complainants decreased to 29% from 34.09% in 2021. If Transfers settled in favour of complainants are included, the percentage increases to 38%.

4. Declined claims the biggest reason for complaints

Insurers’ declining claims because the policy terms or conditions were not recognised or met remained the biggest reason for complaints, comprising 44.99% of finalised complaints. However, there were fewer of these complaints last year, 1 579 compared to 1 761.

The two categories where complaints increased in 2022 concerned claims declined because of non-disclosure, from 121 cases in 2021 to 179 in 2022, and dissatisfaction with policy performance and maturity values, from 37 to 48.

Click here for a summary of finalised full cases by type of complaint.

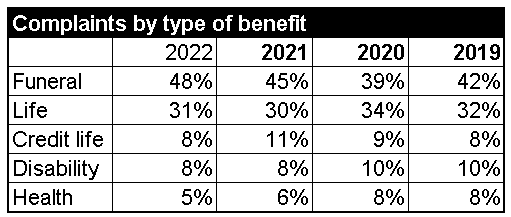

5. Increase in complaints about funeral benefits

Complaints about funeral policies (as a percentage) again increased in 2022. This has been a marked trend over the past two years. The percentage of credit life complaints returned to pre-Covid-19 levels.

6. R200m recovered for complainants

Despite the decline in complaints, the Olti recovered R200 836 922 for complainants in the form of lump sums last year compared with R200 689 324 in 2021. The Olti increased its standard case fee by 7% in 2022, from R4 406 R4 720.

7. Decrease in poor-service compensation

The amount of compensation awarded to complainants because of poor service by an insurer came to R857 544, compared to R948 592 to 2021.

8. The Olti finalised 9.9% fewer cases

Finalised cases include Full Cases and Reviews. These resolved cases came to 3 510 in 2022, a decrease of 9.9% compared with the 3 899 in 2021. Of the cases finalised, 3 183 (2021: 3 516) were finalised without requiring a final determination. In 327 (2021: 383), or 9.3%, of cases, a final ruling was issued. In total, including Transfers closed, 7 034 complaints were finalised in 2022 (2021: 7 533 complaints).

9. 3Sixty Life again sent the most second reminders

The Olti publishes the names of insurers that were sent more than five second reminders in the year to respond to the office. Last year, these insurers were: 3Sixty Life, 33 second reminders; Emerald Life, 12; and Hollard, 8.

In 2021, seven insurers were sent more than five second reminders – which included 3Sixty (200), Emerald Life and Hollard, each with nine.

10. Decrease in Incompetent Cases

The office charges double or triple the Standard Case fee for what it calls Incompetent Cases. These are cases in which the insurer’s response was late or inadequate. The number of Incompetent Cases decreased from 185 in 2021 to 129 last year, which was below the 142 in 2020.