A recent study by DebtBusters explores how consumers spend their money apart from debt repayments, disclosing diverse spending habits across different income levels. With an average of 68% of take-home pay directed towards servicing debt in the fourth quarter of 2024, the study shows how the remaining 32% of disposable income is used and where savings are made to stretch these funds.

The analysis, based on consumers who sought debt counselling, offers insights into spending priorities as the country anticipates the Budget Speech on 12 March. DebtBusters is the largest debt management company in South Africa.

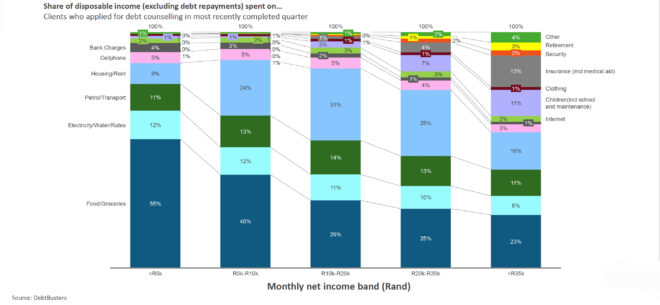

The study categorises consumers into five take-home income brackets: under R5 000 a month; R5 000 to R10 000, R10 000 to R20 000, R20 000 to R35 000, and more than R35 000 a month.

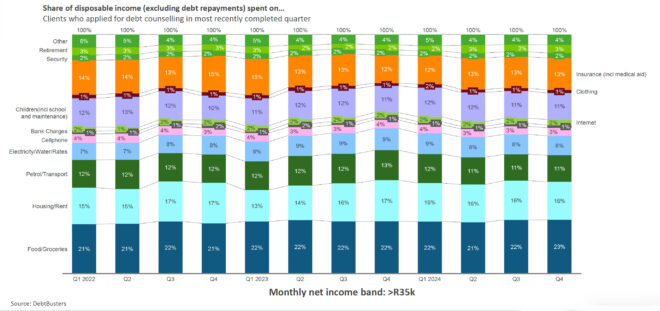

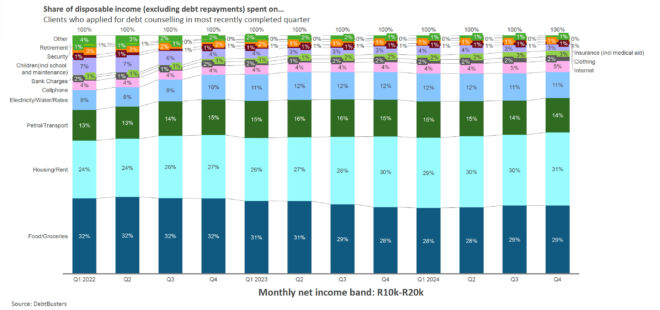

Predictably, there are differences between income groups, particularly in food and housing expenditure. However, spending on transport (13%), utilities (11%), and cellphone contracts (5%) is consistent across all income groups, indicating these are essential expenses that do not vary significantly with income.

There is a significant variation in spending on accommodation. Consumers earning under R5 000 allocate only 9% of their non-debt disposable income to accommodation, whereas those in the R10 000 to R20 000 bracket spend 31%, the highest proportion among all groups.

Food expenditure also differs sharply. The lowest earners (under R5 000) dedicate more than half of their remaining income to groceries. In contrast, top earners (more than R35 000) spend only 23%, reflecting a smaller proportional burden as income rises.

Spend on insurance, including medical scheme cover, is negligible in the two lower income bands but increases from 1% in the R10 000 to R20 000 band to 13% among top earners.

Higher electricity costs and food inflation have forced people in the lowest income band to pool their resources more effectively to cut back on accommodation expenses. Over the past three years, the proportion of non-debt-repayment take-home pay these consumers spend on accommodation has halved, from 20% to 9%.

This contrasts with people taking home between R10 000 and R20 000, the backbone of the country’s working population. Excluding debt repayments, they spend 31% of their take-home pay on housing, an increase of 7% in three years. To make ends meet, they are cutting back on groceries and spending on their children.

Saving for retirement is a low priority. Only the top two income bands (R20 000 to R35 000 and more than R35 000) allocate any funds to long-term savings. Benay Sager, the executive head of DebtBusters, says this is a concerning trend, underscoring the need for enhanced financial education.

Those earning more than R35 000 face the heaviest debt-service burden, with a total debt to annual net income ratio of 187% in the fourth quarter of last year, and they need 74% of their take home pay every month to service their debt repayments. However, their budgets demonstrate greater stability, with fewer fluctuations over the past three years compared to lower-income groups.