South African multi-asset portfolios attracted more than half of the R108 billion in total net inflows for the year to the end of December 2022. The R59bn invested in multi-asset portfolios was the highest net inflow achieved by these portfolios since 2016/17, according to the latest statistics from the Association for Savings and Investments South Africa (Asisa).

The South African multi-asset category comprises 769 portfolios across six sub-categories: income, flexible, high equity, medium equity, low equity, and unclassified.

Sunette Mulder, senior policy adviser at Asisa, said investors took an interesting approach to last year’s rollercoaster investment environment, which presented increasing interest rates and pockets of opportunity in the equity market.

Investors opted in almost equal parts for both multi-asset income portfolios (R24.5bn) and high equity portfolios (R21bn).

Also popular with investors were portfolios in the South African interest-bearing variable term sub-category, which attracted net inflows of R24.1bn in 2022.

Mulder said the highest net outflows in 2022 were recorded by portfolios in the South African interest-bearing short term sub-category, which lost R8bn.

“Not surprisingly, given last year’s extreme market volatility, the South African equity categories focused on niche sectors (industrial, large cap, and mid and small cap) also suffered net outflows in 2022, as did the South African real estate general sector,” she said.

Mulder said it was difficult to say whether the amendment to regulation 28 of the Pension Funds Act had an impact on flows. Unit trust funds that comply with regulation 28 can now invest up to 45% of their assets offshore, up from 30% globally and an additional 10% for investments in other African markets (outside South Africa).

Multi asset dominates

The South African collective investments schemes (CIS) industry continues to be dominated by multi-asset portfolios, with just under half of assets (49%) in these funds.

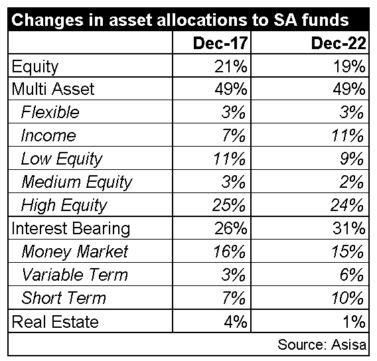

Whereas 44% of all international CIS assets are invested in equity portfolios, only 19% of local CIS assets are held in equity portfolios, with the rest in interest bearing (31%) and real estate (1%) portfolios.

Over the five years to the end of 2022, assets allocated to interest-bearing portfolios have increased from 26% to 31%. Assets held in multi-asset portfolios was the same, at 49%, in December 2017 and December 2022.

Global equity portfolios attracted R9.2bn of investors’ money last year, but this was less than half of what flowed into multi-asset income funds, interest-bearing variable term funds, and multi-asset high equity funds, while money market funds attracted almost the same amount, R9.3bn.

Locally registered foreign portfolios held assets under management of R694bn at the end of December 2022, compared to R698bn at the end of the previous year.

There are 624 foreign currency-denominated portfolios on sale in South Africa.