As South Africans trade home offices for boardrooms, fuel spending is on the rise – a clear sign that the daily commute is making a comeback.

According to Discovery Insure’s 2025 Work From Home Index, nearly 60% of clients are now back in the office five days a week. After a 4% drop in 2023, average fuel spend per active card climbed by 5% in 2024 – a sharp turnaround and a net increase of 9 percentage points.

This trend is among the key findings of the SpendTrend25 report, released last week by Discovery Bank in partnership with Visa. Now in its third year, the report offers a deep dive into consumer behaviour between 2019 and 2024, drawing from Discovery Bank’s credit card data and broader national insights.

Covering seven major metros – Cape Town, Durban, Johannesburg, Pretoria, Bloemfontein, East London, and Gqeberha – the report paints a picture of how different regions are adjusting to shifting financial pressures. It categorises consumers into four groups based on credit card spending levels: High Net Worth, Everyday Affluent, Mass Affluent, and Mass Market.

To add context, an independent survey of 1 000 high-income credit card users was commissioned, uncovering personal insights into payment habits and financial priorities.

Discovery Bank’s chief executive, Hylton Kallner, says the latest comprehensive report identifies shifts in financial behaviour for practical insights into how much people spent, what they spent on, and how they spent it.

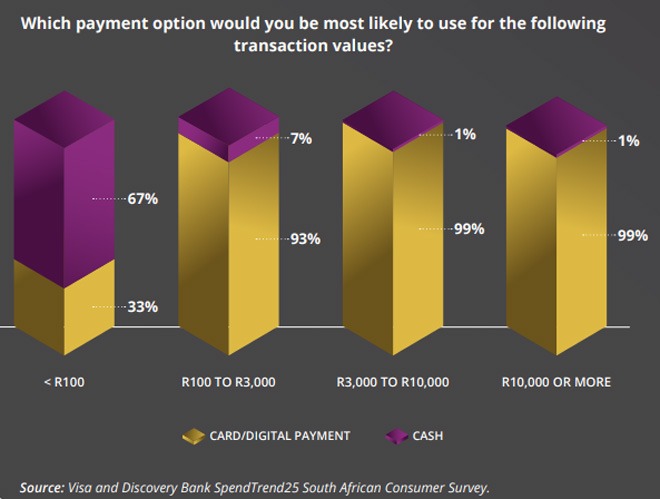

“For example, while we’ve seen a material shift to digital payments in our spend data, this is backed up by consumer preferences whereby over 80% of South Africans surveyed are choosing cards or digital payments over cash whenever they can.”

Lineshree Moodley, country head for Visa South Africa, says their research, in collaboration with Discovery Bank, shows that people across all income levels are making spending decisions with careful planning and strategic use of financial tools.

“The rapid growth of accessible and affordable online and digital payment methods is particularly noteworthy, alongside these advancements.”

How South Africans are spending

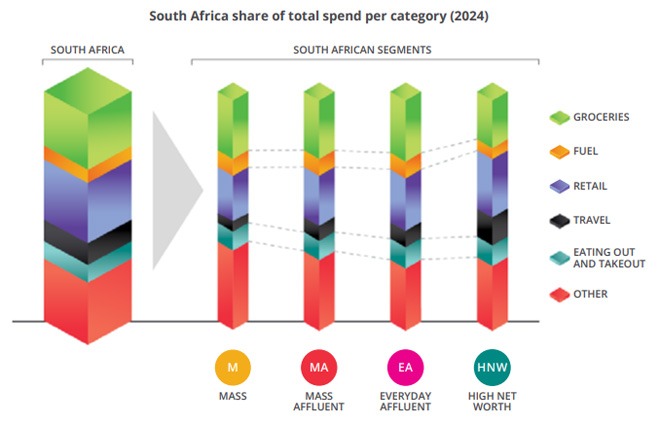

Despite the economic pinch, South Africans continue to spend the bulk of their money on a handful of familiar categories: groceries, retail, travel, eating out and takeout, and fuel. These five areas account for more than 70% of total consumer spending, but where that money goes – and how it is spent – varies significantly by income group and location.

The latest SpendTrend25 report discloses how consumer priorities shift across the spectrum. Although groceries remain the biggest expense for most, high-net-worth individuals carve out more room for life’s luxuries. This group spends three percentage points more of its total spend on travel and one point more on dining out compared with the national average.

In contrast, the mass and mass affluent segments are focused more on day-to-day essentials.

“This highlights how consumers with lower spending power focus more on essentials like groceries and fuel, leaving less for discretionary spending on travel and retail,” the report notes.

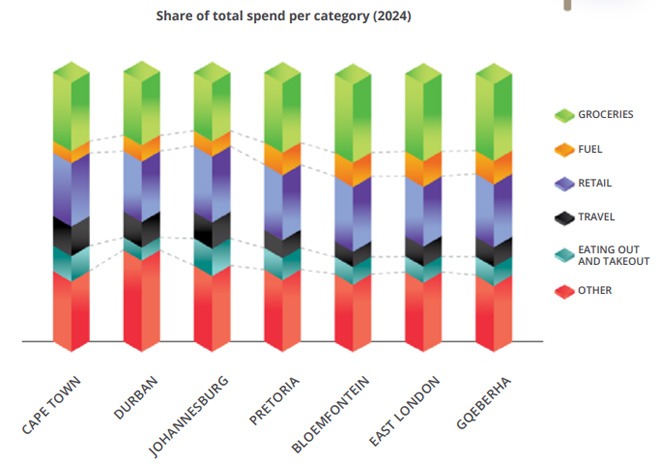

How your city shapes your spending

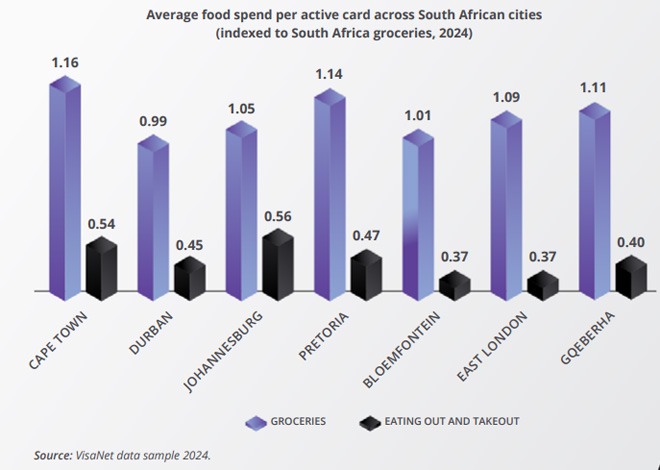

Where you live also plays a surprising role in how you spend. Across all metro areas, food dominates spending – both at the grocery store and on meals out. But the proportions vary widely.

Johannesburg residents spend less on groceries and more on shopping and dining out than those in Durban and Cape Town. Capetonians lead the pack when it comes to grocery spending, while Joburgers prefer to splurge on takeout and restaurant meals.

Meanwhile, residents of Bloemfontein, East London, and Gqeberha spend a larger share on food and fuel, and far less on travel and eating out. In these cities, daily necessities dominate over luxuries.

Coastal hubs such as Durban and Cape Town offer a wider range of social experiences, which may explain why dining out does not dominate their spending in the same way it does in Gauteng.

Convenience reigns supreme

Convenience reigns supreme

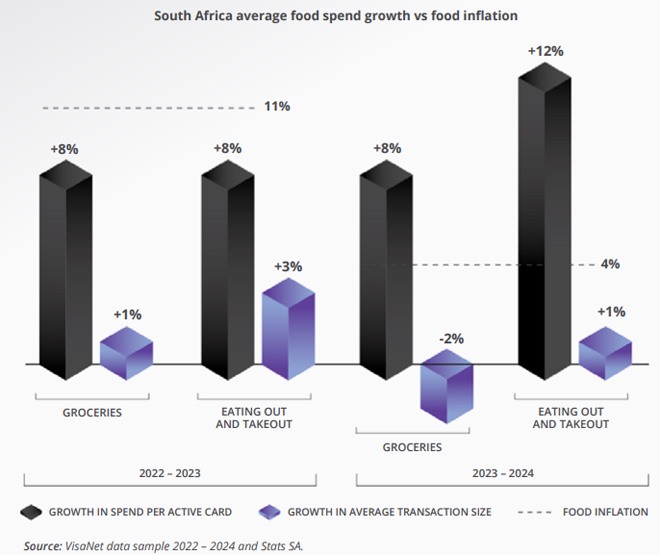

Another clear trend is the growing demand for convenience – particularly when it comes to food. Spending on takeout and restaurant meals jumped 12% in 2024, outpacing grocery spend growth, which rose 8%.

“This increase isn’t just due to food inflation – demand for convenience is shaping consumer habits. People are dining out more often and ordering takeaways more frequently, leading to higher overall spend per card, even as the average grocery basket size declines due to more frequent, smaller purchases,” the report notes.

Interestingly, this doesn’t mean consumers are ditching healthy options. Digital platforms are being used for everything from fast food to meal kits and health-focused delivery services.

According to the Euromonitor Consumer Lifestyle Survey, 32% of South Africans now order takeout at least once a week – up from 26% in 2023 – and 27% plan to dine out in the coming year.

Spending more, despite rising costs

Although food prices remain volatile, spending on food and groceries continues to outpace inflation. This, the report notes, is because food is relatively price inelastic – we need it, no matter the cost.

“To manage rising costs, consumers are likely to prioritise value-based spending or switch to more affordable alternatives, such as store brands instead of name brands,” the report adds.

Online vs in-store: a split in behaviour

When it comes to groceries, online shopping is gaining ground. Online spend is up 15%, compared to just 6% growth in in-store spending. But when it comes to prepared meals, South Africans prefer the experience of dining out: restaurant spend grew 13%, versus 10% growth in online takeout orders.

The takeaway?

“This shows that grocery shopping is seen as a convenient task to do online while dining out is more of a social experience enjoyed in person.”

Travel is back – but differently

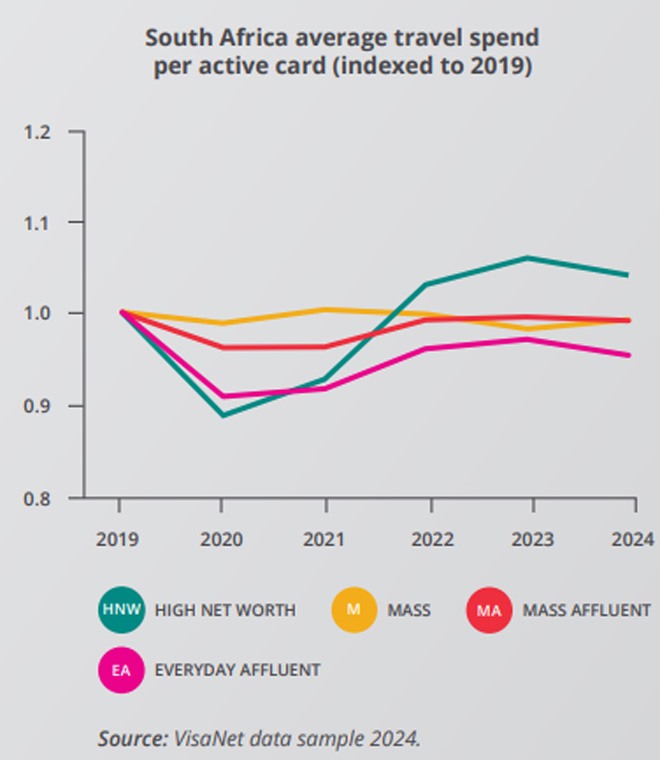

The report shows travel is costing locals more.

“Travel spending rebounded for the mass market segment after a previous dip, but decreased for mass affluent, everyday affluent, and high-net-worth segments.”

Report adds that travel spend is returning to normal, but at a higher cost per trip. Although total travel spending has increased, the number of travel transactions per active card has dropped across all segments.

“Although overall travel spending slowed in 2024 compared to previous years, the post-pandemic recovery continues,” the report notes.

Digital over cash: How South Africans are changing the way they pay

From the bustling streets of Johannesburg to the beachfront cafés of Cape Town, South Africans are reaching for their phones, not their wallets, when it’s time to pay.

Digital transactions are quickly replacing cash, as convenience, security and rewards tip the scale in favour of cards, apps, and virtual wallets. The trend is widespread – and accelerating.

According to survey, 67% of respondents said they now use cash only a few times a month, or not at all. Among those aged 51 and older, that figure jumps to 81%, revealing just how far digital adoption has come across age groups.

The data also shows that 84% of South Africans prefer using cards or digital payments whenever possible, with younger consumers leading the charge.

“This shift is especially strong in Johannesburg and Cape Town, where digital payments are becoming the norm,” the report notes.

Cash, once king, is increasingly relegated to small purchases – often more out of habit than necessity.

Virtual cards gain ground

According to the report, one of the strongest signals of the move toward digital is the rising popularity of virtual cards – digital versions of plastic bank cards with unique 16-digit numbers, expiry dates and CVVs. They offer the same benefits as physical cards, including purchase protection, extended warranties, and travel insurance – but with more flexibility and better security.

Issued instantly via banking apps, virtual cards let users start transacting immediately. This is a major draw, particularly as online fraud becomes more sophisticated.

“Virtual cards are increasingly being favoured for their enhanced security and control over spend, making them a top choice for digital transactions,” the report states.

Nearly half of those surveyed – 45% – are already using virtual cards. Another portion owns one but hasn’t yet started using it, signalling an opportunity for more education around the benefits.

Mobile wallets on the rise

Mobile wallets are also booming. In-store payments made via smartphone or smartwatch are fast becoming a fixture at checkouts around the country. You can now add both physical and virtual cards to your digital wallet and pay with a quick tap.

In 2024, digital wallets’ share of in-store purchases grew by 9%, echoing the same growth seen in 2023. Digital payment platforms like Apple Pay and Samsung Pay now account for 22% of all transactions, according to the PayFast State of Pay 2024 Study.

And the appetite for these tools is growing. According to the Visa Stay Secure Study 2025, 68% of South Africans plan to increase their use of digital payments in the year ahead.

As retailers expand their acceptance of mobile payments and banks continue to roll out innovative digital solutions, the slow fade of cash seems inevitable.