Policyholders’ misunderstanding of what is meant by waiting periods in the context of income protection policies was the main reason FMI rejected claims last year – and buying a policy with an inappropriate waiting period is also likely to result in disappointment at claims stage.

FMI, which released its claims report for 2020, predominately sells income protection – about five times more than the rest of the market, it said.

The life insurer said 87% of its claims in 2020 were for income protection. Seven percent of claims were for ancillary benefits such as retrenchment cover. Critical illness and life cover each accounted for 3% of claims, and fewer than 1% of claims were for lump-sum disability.

FMI paid out 92% of all lodged (not valid) claims last year. In previous years, the main reason for claims being rejected was non-disclosure, but in 2020 the leading cause of non-payment was that clients tried to claim under their income protection policies while still within their waiting period.

Many policyholders assume a waiting period is similar to the waiting period at the inception of medical scheme membership or a funeral policy, whereas it means the number of days a policyholder must be sick or unable to work before a claim will start paying.

“This is a point that intermediaries need to emphasise,” said FMI said.

Waiting period-claim duration mismatch

According to the claims report, 40% of claims had a duration of less than 30 days, but 64% of temporary income protection policies sold had a waiting period of 30 days or longer.

The average duration of Covid claims was 18 days, but claimants with a seven-day waiting period accounted for 86% of Covid claims.

“This has highlighted the need for consumer education around concepts such as waiting periods to ensure that clients understand and select products that suit their needs,” said FMI’s chief product actuary, Leza Wells.

The average claim duration was 78 days, with 80% of claims lasting less than 90 days. The average claim duration for a stroke was 367 days.

Less than 3% of claims had a duration of more than 24 months, and four out 10 claims that lasted longer than two years were not for permanent disability.

Other areas policyholders should understand

In addition to waiting periods, FMI said brokers should ensure their clients understand the following:

- The criteria that will be used to assess their claims.

- The type of cover they have in place – policyholders need to understand that income protection pays for temporary and permanent injuries or illnesses, whereas lump-sum disability will pay only if they are permanently disabled.

- The basic exclusions, such as claims for self-inflicted injuries and those arising from hazardous pursuits.

Covid-19 has a major impact on claims

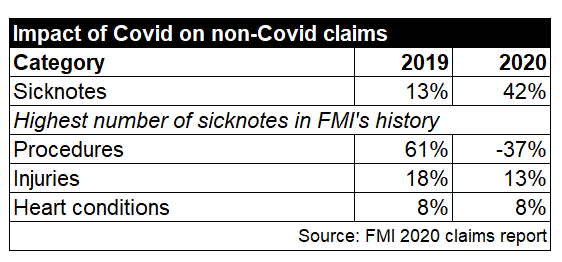

FMI saw the highest number of claims in its 26-year history in 2020, with claim volumes increasing by 17% compared to the previous year because of a sharp increase in temporary income protection claims related to Covid-19.

As in previous years, minor infections were the leading cause (31.2%) of all income protection claims in 2020 – although there were more claims, and they were mostly due to Covid-19 infections and complications as opposed to flu and bronchitis.

“Covid-19 has had a major impact on the life insurance industry, with significant increases in claims for income protection, retrenchment, death and funeral claims. Whilst we saw a higher-than-usual number of income protection claims, our exposure to the virus was limited, because we have a newer book with younger ages that have been underwritten more recently,” said Wells.

Lump-sum benefits aren’t always appropriate

FMI said only two of its top 10 claim causes for income protection last year were for conditions that would likely have resulted in a lump-sum payout. Fewer than 1% of claims were paid on lump-sum disability, “which shows that there are a number of injuries and illnesses that impact your ability to work that won’t result in a claim on critical illness or lump-sum disability cover”.

Despite this, FMI said most policies sold in the industry in 2020 didn’t include income protection. Lump-sum benefits dominate sales in the life insurance market, with life cover representing 61% of new sales. Lump-sum disability and critical illness sales account for a further 32%, while income protection accounts for only 7% of sales, according to FMI.

“At FMI, we’ve always believed that income protection cover should be the foundation of your financial plan. Your monthly income pays for your short-term insurance, medical aid, lump-sum cover, your savings and retirement plan. Even a short-term interruption in your income due to injury or illness places your entire financial plan at risk. For us, financial planning should start by asking: ‘How will I provide for myself and my dependants if I get ill or injured and I can’t work?’” said Wells.