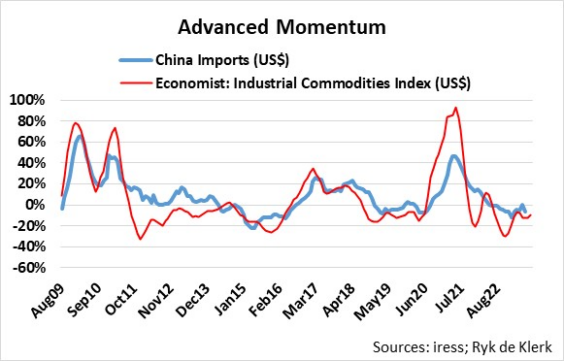

Commodity prices continue to take strain as high interest rates and inflation weigh on consumer spending, slowing global growth. The Economist Industrial Commodity Index is down by 28% in US dollar terms from its highs of 2022 when Russia invaded Ukraine. The index has underperformed developed-market equities, as measured by the MSCI World Index, by more than 14% since the end of last year.

Yes, some of the worst-performing asset classes, but the upside risks to industrial commodity prices are slowly but surely starting to outweigh the downside risks.

The restrictive zero-Covid policy that the People’s Republic of China put in place in response to a massive outbreak, specifically in the second half of last year, reverberated across the globe.

There was a much-expected flare-up in economic activity in the first few months of this year after the restrictions were rolled back in December last year. According to Fung Business Intelligence, economic growth accelerated to more than 6% year-on-year in the second quarter, while retail sales registered year-on-year growth of 8.2% in the first half. Since then, China’s economic recovery has been disappointing.

Dark clouds over China’s economy

Businesses in China are on strike.

Business confidence is waning, leading to a deceleration of growth in fixed-asset investment. According to findings by the American Chamber of Commerce in South China, most companies polled in the second quarter indicated they were sticking with the investment plans they made before the restrictive Covid policy ended.

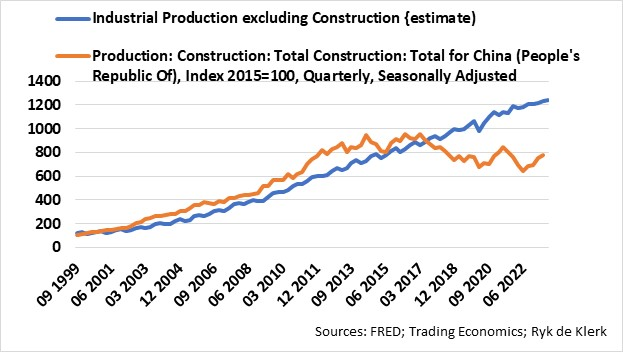

The building and construction industry is China’s nemesis. Production has contracted by more than 1.5% a year since 2014. The construction industry accounts for about 7% of China’s GDP. China’s industrial production, including construction, has been on a steady decline to less than 5% from more than 8% 10 years ago. The indications are that if nothing seriously is done, China’s GDP growth could fall to below 4% by the end of next year.

Consumers are also on strike.

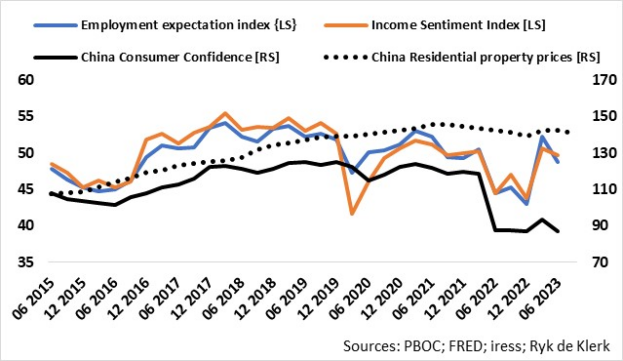

Employment expectations and income sentiment bounced back to pre-restrictive zero-Covid levels last year, but consumer confidence has not followed suit.

Although the 150-basis point cut in interest rates from the end of 2014 to December 2015 did much to improve China’s property market, as residential property prices recovered, prices have been in a downward trend since 2021, despite easier lending conditions. China’s real estate sector is in dire straits, and the contagion is threatening China’s financial system.

According to data released on Sunday, China’s economy lost further momentum in July. Bloomberg reported that growth in consumer spending, industrial output, and investment was struggling across the board, while “consumer and producer prices registered the first synchronised decline since late 2020”.

Yes, China could be considered “ex-growth” in investment jargon.

Pro-growth policies

The big plus for China’s economy is that the government has – although it has been slow out of the blocks – started to introduce policies to support the struggling construction industry. Key interest rates were recently cut by the most since 2020, while some housing policies were eased to reverse the decline in the residential property market.

The Chinese Communist Party’s politburo in July turned pro-growth, and Chinese economists, such as Fung Business Intelligence, expect the government to put more effort into “proactive monetary and fiscal policies to create synergy for expanding demand”. In other words, to restore consumer and business confidence.

Major stimulus efforts are likely to lead to a stronger recovery than is generally expected in China’s industrial sector and are likely to underscore commodity prices.

Commodity prices are very sensitive to Chinese growth, as the country accounts for about half of the global demand for metals. Over the past few years, commodity price momentum tended to lead China’s imports by three months. The behaviour of commodity prices over the next few months will therefore be an indication of the health of China’s economy.

China may be the catalyst

An equally weighted index of physical stocks of industrial metals (nickel, copper, lead, aluminium) on the London Metals Exchange is currently at its lowest level in more than a decade. Furthermore, the momentum of US manufacturers’ inventories to sales ratio indicates that inventories at manufacturers are not excessive.

The US manufacturing sector, as measured by the purchasing managers’ index, has been in contraction territory since November last year, and a return to expansion may catch manufacturers short of inventories.

China may be the catalyst, as improved demand will flow over to increased export order books in the rest of the world, and as in previous upswings, commodity prices are likely to benefit strongly when the manufacturing sector rebounds.

Commodities are not out of the woods yet, and prices are still bottoming. But nobody is going to ring a bell to call the bottom, specifically for lithium, copper, and nickel, which will see significantly higher demand from the transition to renewable energy in the longer term.

Yes, the upside risks to industrial commodity prices are gathering momentum! At this stage, I favour real tangible assets in lieu of financial assets.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.