Although all eyes are on the results of this week’s general election, investors, including retirees and their fund managers, have to grapple with BHP Group’s proposed takeover of Anglo American Plc, which would create the world’s top copper producer.

BHP’s surprise bid for Anglo American has already had a massive impact on South Africa’s financial markets. Since the bid was announced in late April, Anglo jumped more than 20%, and the FTSE/JSE All Share and Financial indexes gained more than 6% and 9%, respectively. Long-term SA government bond yields fell, leading to a 4% gain in the BESSA All Bond Index, while the rand appreciated by about 4% against major currencies such as the US dollar and euro.

It does seem that investors were influenced by the deal rather than politics, but the bid focused offshore investors’ attention on how inexpensive some South African-domiciled assets were.

Whither Anglo?

The value of BHP’s third and perhaps final bid is about US$38 per Anglo share and is about 11% higher than Anglo’s closing price of about US$34 per share on the JSE on Thursday.

It is, however, uncertain whether BHP’s bid for Anglo will succeed. Smaller shareholders are in the hands of Anglo’s board of directors, as well as major shareholders such as the Public Investment Corporation, on whether or not the bid will be accepted.

If the bid is rejected and no other bidder comes forward, the market will re-evaluate Anglo’s own restructuring plan that will largely mirror BHP’s planned restructuring of Anglo pre- and post-takeover.

How much is Anglo worth?

Net present values of long-term cash flows are normally considered in the valuation of mining projects and may differ significantly from market values as calculated by the market capitalisation of the listed instrument. The latter is a combination of market sentiment influenced by commodity prices, exchange rates, domicile, etc. In addition, in my experience, holding companies tend to trade at discounts of up to 30% of their net asset values – listed or unlisted.

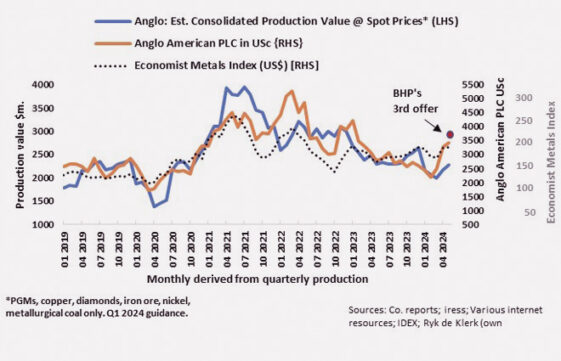

In mid-January this year (Anglo stock investment cycle: time to stay or time to go?), I justified holding Anglo because of the quality of its assets, the apparent discounts to the metals index and consolidated production value at the then prevailing prices, and the possible early stage of a new commodity super cycle. In my opinion, the fair value of Anglo was about 2 700 US cent (GBP 21.2; ZAR 500) per share compared to the then stock price of about 2 400 US cents (GBP 18.8; ZAR 441).

Using the same methodology as before, I estimated the historical quarterly consolidated value of Anglo’s mining production by applying spot commodity prices to the company’s production of the major commodities and compared it to Anglo’s share price.

It is evident that Anglo’s stock price made up all the lost ground relative to the Economist Metals Index (US$) and diverted significantly from the consolidated production value trend. I am therefore of the opinion that BHP’s offer for Anglo is reasonable.

BHP’s timing is excellent because it is apparent that the bull market in commodities is firmly under way, underpinned by supply deficits. BHP’s management is renowned for their relatively active asset management, and they are good at it. BHP’s earnings per share grew by double figures over the past six years, while Anglo’s earnings went nowhere. BHP’s price-to-book ratio is more than 3 compared to 1.7 times for Anglo’s, while BHP’s forward PE is 12 times earnings and Anglo’s is 16 times earnings.

Will there be another buyer, or will the cycle be on Anglo’s side?

That is why I opt for BHP rather than Anglo.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.