Since April last year, the rand has fallen by more than 26% and 24% against the euro and US dollar respectively, coinciding with massive capital outflows (government bonds and stocks) due to South Africa’s “self-inflicted wounds” as central bank Governor Lesetja Kganyago said recently.

Is there light at the end of the tunnel?

The behaviour of the rand should not be seen in isolation, though, and is best compared to the other currencies of the BRICS group of emerging markets.

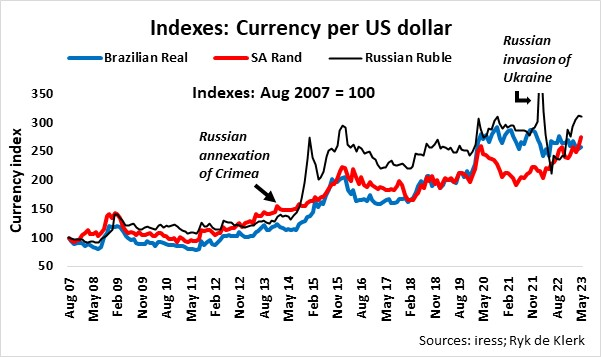

India and China are politically and economically more stable than Russia, Brazil, and South Africa. I indexed the US dollar exchange rates of the South African rand, Brazilian real and Russian ruble to 100 a few months before the global financial crisis struck.

The ruble traded in line with the rand and the real from before the global financial crisis (August 2007) until just after Russia annexed Crimea in the first quarter of 2014.

The annexation of Crimea resulted in a financial crisis in Russia because of economic sanctions against the country by the US and others and a rapid collapse of the ruble in the global forex market.

From the third quarter 2014 until December 2020, the ruble traded at a discount of about 20% on average against the rand.

Russia’s invasion of Ukraine in February 2022 saw a rapid collapse of the ruble, but a recovery briefly eliminated the discount to the rand. Subsequently, the ruble weakened to pre-invasion levels, but a steep depreciation of the rand against the US dollar and other currencies resulted in the discount of the ruble against the rand closing to about 11%.

The Brazilian real traded roughly on par with the rand until the outbreak of the Covid-19 pandemic. When the pandemic hit Brazil in early 2020, then-president Jair Bolsonaro and his government’s ignorance and their belittling of the pandemic caused global forex and capital markets to derate Brazilian markets. From June 2020 until December 2021, the real traded at a discount of about 22% on average against the rand and 6% against the ruble. The rand’s stellar performance against the real over that period can largely be attributed to South Africa’s commendable handling of the pandemic and relatively decent economic recovery.

The change in the guard in Brazil at the end of 2022 saw the discount of the ruble against the real opening to about 17% currently.

South Africa’s “own goals”, starting with the Zuma riots in mid-2021, followed by President Cyril Ramaphosa’s Phala Phala Farmgate later that year and the deepening electricity crisis led to a steep decline in the external value of the rand since April 2022. As such, the real is currently trading at a 7% premium to the rand.

It is evident that extraordinary arbitration opportunities emerged in the third quarter of 2021 as the yield gap between Brazilian 10-year government bonds and South African bonds opened 200 basis points in favour of Brazil. At the same time, the real traded at a discount of more than 20% to the rand.

The bond yield gap has now closed, and the real is trading at a small premium to the rand. Yes, the arbitration opportunities are gone as South African government bonds and the rand are trading at fair value to Brazil’s markets.

Were plain market forces responsible for closing the gaps, or were the “own goals” deliberate to force a devaluation of the rand an attempt to align currencies, considering the upcoming BRICS summit and the possible introduction of a BRICS currency? Is the South African government banking on funding from BRICS’s New Development Bank for projects such as green energy, the rescue of parastatals, and generally cheaper loans, and, more importantly, the relative stability of the rand by adopting a BRICS currency? Only time will tell.

It seems the government is at long last seeking to do the “right” things to avoid further economic and social decay, to avoid “skunk” status reflecting the levels at which the ruble is trading.

The rand, as in the case of other emerging market currencies, may come under further downward pressure again as prospects for a global recession loom. The current phase in the global economic cycle is normally associated with “risk off” investment strategies whereby the market tends to shun economic cyclical stocks in favour of growth stocks.

In my opinion, South Africa is ahead of the curve. The massive sale of more than R200 billion of South African government bonds by foreigners since the beginning of last year had to be financed locally to absorb the bonds, mostly through the sale of equities by local financial institutions. The downward pressure exerted on the local stock market was further aggravated by foreigners offloading South African stocks, forcing selected stocks to trade at significantly lower valuations than their counterparts offshore.

I have therefore turned positive on the rand and domestic assets, as most of the bad news seems to be reflected in current market prices.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate to every individual’s needs and circumstances.

it makes sense…if the bricks currency can solve our dollar exchange then why not but Russia must come to the party. banks are largly the problem globally so with this should come tech companies acting like banks. like the Apple/ Goldman sachs deal. better interest rates form investment capital.

It does not help to be positive- you have to be realistic- every time an ANC member opens his/her mouth or act strangely, it affects the Rand. The tragic part is that Stern ANC supporters cannot see that it is the ANC that stuffs up the Rand and not the public, yet the public gets punished for their sins via Interest rate increases. The ANC must go in 2024 as it is the only chance of survival for South Africans

Currently, we have aligned ourselves with the east, China, possible war monger over Tiawan, Russia, invasion Ukraine and Crimea.Russia is so broke it is likely to collapse. Brazil is going through a Brazilian spring. and is likely to implode. should we then align ourselves with this lot,

should the UAE and others become involved it could work. But at present it’s a lot of communist dogma and which has failed Bear in mind almost everything is sold in dollars so how do you trade outside of Brics if the western bank won’t recognize our new currency, America currently trades with SA to the tune of about $60 billion. UK about 21 billion pounds without backing for a Bric’s bank supported by a hard currency. I dont think it will work