Starting to save at a young age and saving as much as possible are two frequently cited investment basics. Another, less frequently mentioned variable is that bear markets, market downturns, and recessions are more normal than many investors imagine, says Adriaan Pask, the chief investment officer at PSG Wealth.

If investors were to understand that markets could fall by about 10% almost every year, they would be more prepared and less likely to panic and make investment mistakes during periods of volatility. Pask expands on this argument in this article.

The world has not technically entered a recession or bear market, but the likelihood that it will is high. Data confirms that during an average bear market cycle, it takes more than nine months for the markets to recover. The 2022 cycle lasted eight months, and markets fell by about 25%. It seemed the markets were recovering, but given the risks, we may not have seen the end of this latest correction cycle.

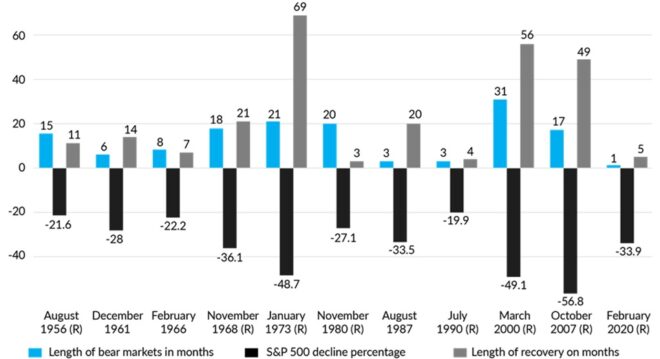

Graph 1 below depicts how long previous bear market cycles lasted on the S&P 500. One cycle, the 1973 and 1974 bear market, lasted more than 20 months. In that time, the index plunged by almost 50%, and the subsequent recovery took more than five years (69 months). This data (and other research studies) has established that market participants should anticipate an equity market decline of at least 10% every 18 months, and a drop of at least 20% every five years.

Graph 1: S&P 500 bear markets and recoveries

(R) = Bear market coincides with a recession.

Sources: LPL Research and CFRA FactSet, Investopedia

Locally, we should expect the FTSE/JSE All Share Index to exhibit considerable volatility akin to other emerging markets.

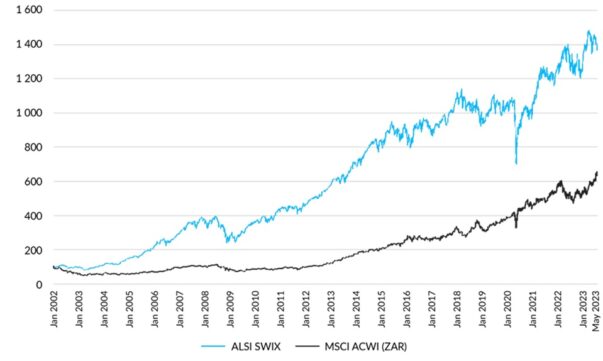

Emerging markets frequently offer greater long-term gains, but they can also be highly volatile in the short term. Graph 2 shows how the JSE grew despite the negative sentiment caused by, among other things, “Nene-gate”, the US-Sino trade war, the turbulence of the Zuma era, the Phala Phala report, severe loadshedding, and South Africa’s addition to the Financial Action Task Force’s grey list. If you invested R100 in the Alsi in 2015, your investment could have grown to R162.46 (62.46% cumulative growth) over that period.

Our data and other research have shown that market setbacks or declines are part of the normal investment experience, but this something that investors often forget when the next one hits. For this reason, it’s critical that investors prepare and manage their expectations when considering their wealth creation journey, particularly during tough economic climates.

Graph 2: Cumulative returns of the Alsi Shareholder Weighted Index outpaced its global counterpart, the MSCI All Country World Index, in rand terms

Sources: Factset, PSG Wealth research team

Among the best ways to earn an excellent return on your investment is to start early. The reason this is important is mainly the power of compound interest.

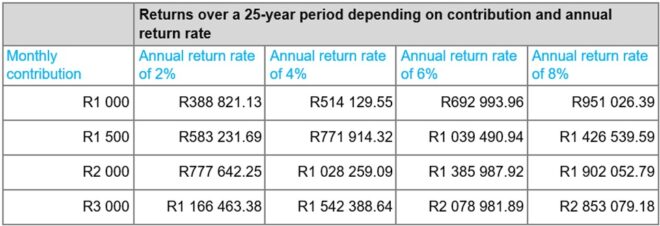

The calculations below show how the growth on an investor’s portfolio can vary depending on the amount you invest each month and the investment returns received over a year. This demonstrates that if you start at a young age with a smaller investment amount each month, your investments could grow to more than if you had started investing later in life with the same (or in some instances an even a larger) monthly amount.

Table 1: How your investment could grow depending on your monthly contribution and the returns you receive

Source: PSG Wealth research team

Exercise patience and discipline

Investors should try to avoid acting impulsively or emotionally when markets are extremely volatile because doing so might have devastating consequences for their families and future generations.

It’s crucial to keep in mind that downturns occur in markets more frequently than is generally believed. This is the ride investors can expect when investing in equities. It is also the premium they can expect when staying invested over the long term – particularly during tough times. It is ultimately this expectation of possible downturns and staying disciplined and invested that will, in most scenarios, reward patient investors.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.