Most investors are used to two general types of stocks: growth and value. Growth stocks are stocks with a potential for above-average earnings growth, while value stocks tend to refer to those trading below their intrinsic value.

Then you have Veblen stocks. In general market theory, the law of demand states the demand for a good increases when the price of the good drops, and vice versa, demand decreases when the price rises. A Veblen good, named after American economist Thorstein Veblen, “is a type of good for which demand increases as the price rises” (Investopia).

It is perhaps best summarised by the Corporate Finance Institute: “The abnormal demand for Veblen goods is influenced by the snob effect, a situation that consumers prefer to own exclusive products that are different from the commonly preferred ones” and to “display one’s economic power and social status, motivated by the desire for prestige”. Yes, typically luxury goods.

According to Bains, the luxury goods market consists of nine segments: luxury cars, personal luxury goods, luxury hospitality, fine wines and spirits, gourmet food and fine dining, high-end furniture and houseware, fine art, private jets and yachts, and luxury cruises.

I characterise Veblen stocks as those that own legacy brands, where long histories differentiate their brands from others, where the brands are protected and seldom go on sale, where it is about the client’s personal experience through in-person reactions, and the desire to own the brands because of their craftmanship, elegance, exclusivity, exquisiteness, and durability. Yes, brands where people are willing to pay a premium for a positive customer experience.

There are more Veblen stocks than those included in my Veblen collection.

Luxury stocks that particularly fit the Veblen characteristics are in the personal luxury goods and luxury cars sectors. In personal luxury goods, I prefer LVMH (brands include Louis Vuitton, Dior, Sephora, Tiffany & Co, Moët & Chandon, and Fenty Beauty), Richemont (brands include Cartier, Van Cleef & Arpels, Montblanc, Chloé, and IWC), and Hermès (Birkin and Kelly bags), while I prefer Ferrari in the luxury car sector.

But Veblen goods stocks are not limited to the luxury goods market.

Apple’s tightly integrated ecosystem, where devices work seamlessly and effectively together, has created a very loyal customer base. Users are prepared to pay. Long lines at Apple stores when new iPhones are released are testimony to that. The saying goes, “iPhones are worth it only if you are rich, and the fact that you are thinking whether to get one or not tells me that you aren’t rich enough.”

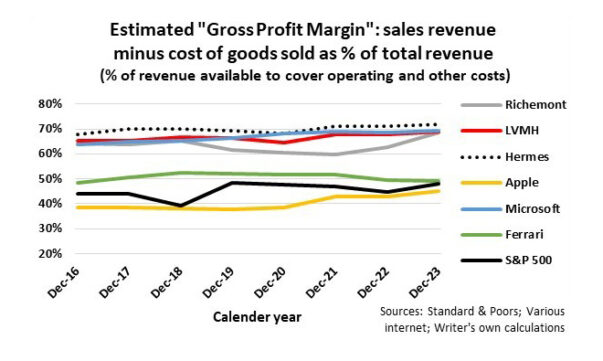

A Veblen company’s pricing power is reflected in its high sustained gross profit margins (sales revenue minus production-related cost of goods sold as percentage of total revenue) relative to the rest of the market. It means the Veblen company is in a better position than the rest of the market to cover operating and other costs, specifically the significant advertising costs that go into protecting the brands.

The annual average gross profit margin of the Veblen companies in the luxury personal goods sector in 2023 was about 70%, with Hermès the highest at about 72%, followed by LVMH at 69%, and Richemont at 68.7%. Input costs say a lot in the case of luxury cars, where Ferrari’s gross margin was about 49% in the same year. Apple’s gross profit margin, at 45%, was lower than the S&P 500’s 48%.

I added Microsoft to my favourite list of Veblen companies. The tech giant has been and still is arguably the leader in the tech industry, with growing positions in multiple areas. According to Investopedia, the company’s competitive advantages and intellectual property protect it from rival companies and enable large profits. Microsoft’s gross profit margin averaged about 69% in 2023.

An important feature of Veblen stocks is that, except for Ferrari, they have all grown their gross profit margins at worst in line with the S&P 500’s since 2016. Apple and Microsoft grew the fastest, at 0.9% and 0.8% per year respectively, Hermès and Richemont at 0.6% each respectively, while LVMH recorded 0.5% per year, and Ferrari a paltry 0.1% per year.

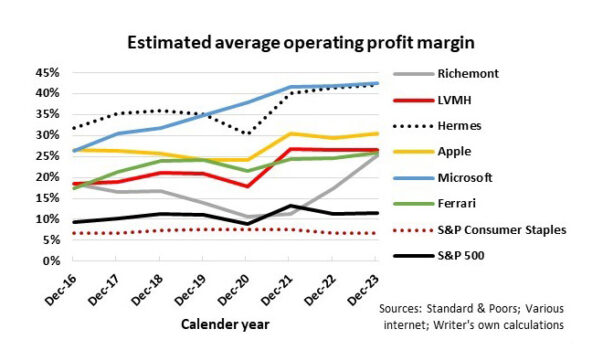

While gross profit margins tell a story about the ability and means to maintain barriers to entry and pricing power, operating profit margins indicate how efficiently companies convert revenue into profit from core operations. Above-average sales growth times above-average operating margin growth equals above-average operating profit growth.

Among the selected Veblen companies, Hermès and Microsoft had the highest average operating profit margins in 2023, at about 42%, followed by Apple at 31%, and LVMH, Richemont, and Ferrari at about 26% – significantly higher than the S&P 500’s weighted profit margin of about 11%.

The qualities of the selected Veblen companies are also reflected in their ability to grow profit margins faster relative to the market. Microsoft registered the highest growth of 1.7% compounded per year since 2016. Hermès, Ferrari, and LVMH grew at about 1% per year, and Richemont and Apple at 0.8% and 0.4% respectively. That compares very favourably to the S&P 500’s 0.3% growth over the same period.

Sales growth of the said Veblen companies also exceeded the S&P 500’s 7% annual growth since 2016. Hermès registered the highest growth of about 15%, followed by Microsoft at 14%, LVMH at 13%, Ferrari at 11%, and Richemont and Apple at 9% compounded per year.

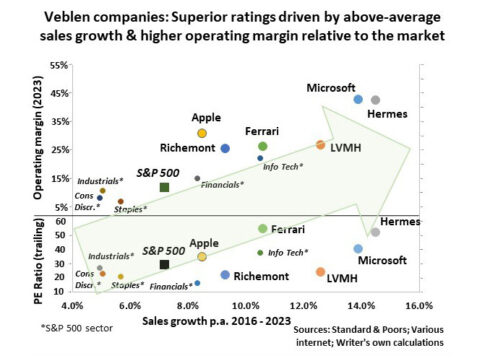

The combination of above-average profit margins (gross and operating), higher margin and sales growth leads to superior company profit growth over the long run and therefore justifies superior ratings relative to equity markets in general. That is why Veblen companies earn their inclusion in my investment portfolio despite their elevated valuation metrics.

Ryk de Klerk is an independent investment analyst.

Disclaimer: The views expressed in this article are those of the writer and are not necessarily shared by Moonstone Information Refinery or its sister companies. The information in this article does not constitute investment or financial planning advice that is appropriate for every individual’s needs and circumstances.