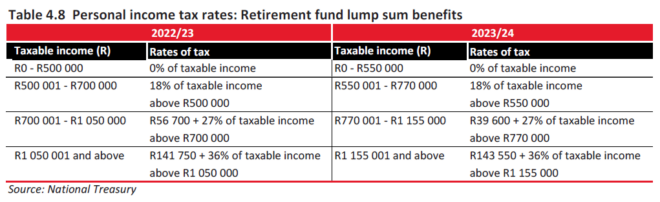

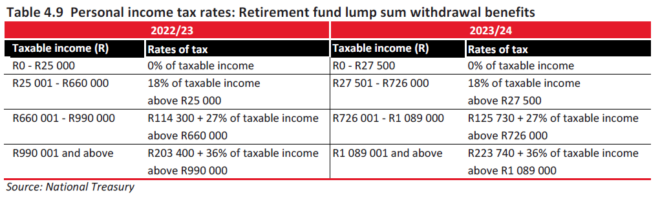

From 1 March, you will be able to withdraw a higher tax-free lump sum from your retirement fund – either before or after retirement.

This is because National Treasury has adjusted the taxable income bands in the pre- and post-retirement tables by 10% to take account of inflation. However, the tax rates have not been changed.

As a result, at retirement, you will be able to take up to R550 000, an increase of R50 000, without paying any tax.

If you make a pre-retirement withdrawal, tax kicks in at R27 500, instead of R25 000.